Eric Van Nostrand, Performing Assistant Secretary for Financial Coverage

Laura Feiveson, Deputy Assistant Secretary for Microeconomics

U.S. Division of the Treasury

The Inflation Relief Act (IRA)—signed by means of President Biden 365 days in the past—is the most important local weather funding in U.S. historical past, designed to mobilize personal capital to succeed in our local weather targets and beef up long-term expansion. The IRA encourages innovation by means of giving companies more than a few demand- and supply-side incentives to put money into creating and deploying blank power applied sciences. Moreover, for a number of key investments, the IRA supplies further place-based bonuses for firms to find in underserved communities the place process advent can have the most important have an effect on at the well-being of the ones communities, and the place such investments can produce upper financial returns.[1] The IRA is a chief instance of what Secretary Yellen calls “trendy supply-side economics”: using govt motion to advertise expansion whilst addressing local weather trade or inequality.

It’ll take a long time ahead of the total results of the IRA at the financial system and the local weather will change into transparent. However 365 days after President Biden signed the IRA, we apply two key tendencies that the IRA is designed to inspire and beef up:

- American industry funding has been particularly sturdy within the post-COVID restoration relative to earlier recoveries, together with analysis and construction (R&D) spending. The IRA, at the side of the Bipartisan Infrastructure Legislation and the CHIPS and Science Act, most likely explains a few of that power.

- Investments which were just lately introduced within the IRA-related sectors of fresh power, electrical cars, and batteries are concentrated in fairly deprived communities with decrease wages, decrease faculty commencement charges, and decrease employment charges. Making an investment in such communities is helping supply alternative to people who are living there but additionally is helping spice up nationwide productiveness expansion.

Industry Funding within the Publish-COVID Restoration

We start by means of reviewing how combination personal industry funding has fared within the fresh restoration. Right here, there may be proof that non-public funding has held up particularly effectively in recent times, regardless of the new build up in rates of interest, which—all else equivalent—would generally tend to gradual funding charges.

Industry fastened funding (BFI) is a standard measure of funding by means of personal firms. In most cases, BFI falls at about the similar fee as general GDP throughout a recession, however then lags different elements within the restoration. Due to this fact, we think to look BFI’s proportion of general GDP fall within the years following a recession. This was once particularly the case following the 2008 Nice Recession, as proven under in Determine 1. However in recent times, BFI has grown a lot quicker than regular at this level within the financial cycle: funding is kind of the similar proportion of GDP because it was once simply ahead of COVID—a greater end result than after each different recession since 1980.

Determine 1

Supply: Bureau of Financial Research; U.S. Treasury calculations. Industry cycle peaks are outlined as the overall quarter ahead of a recession starts as decided by means of the Nationwide Bureau of Financial Analysis; all industry cycle peaks since 1969 are incorporated in “Moderate Recession & Restoration.”

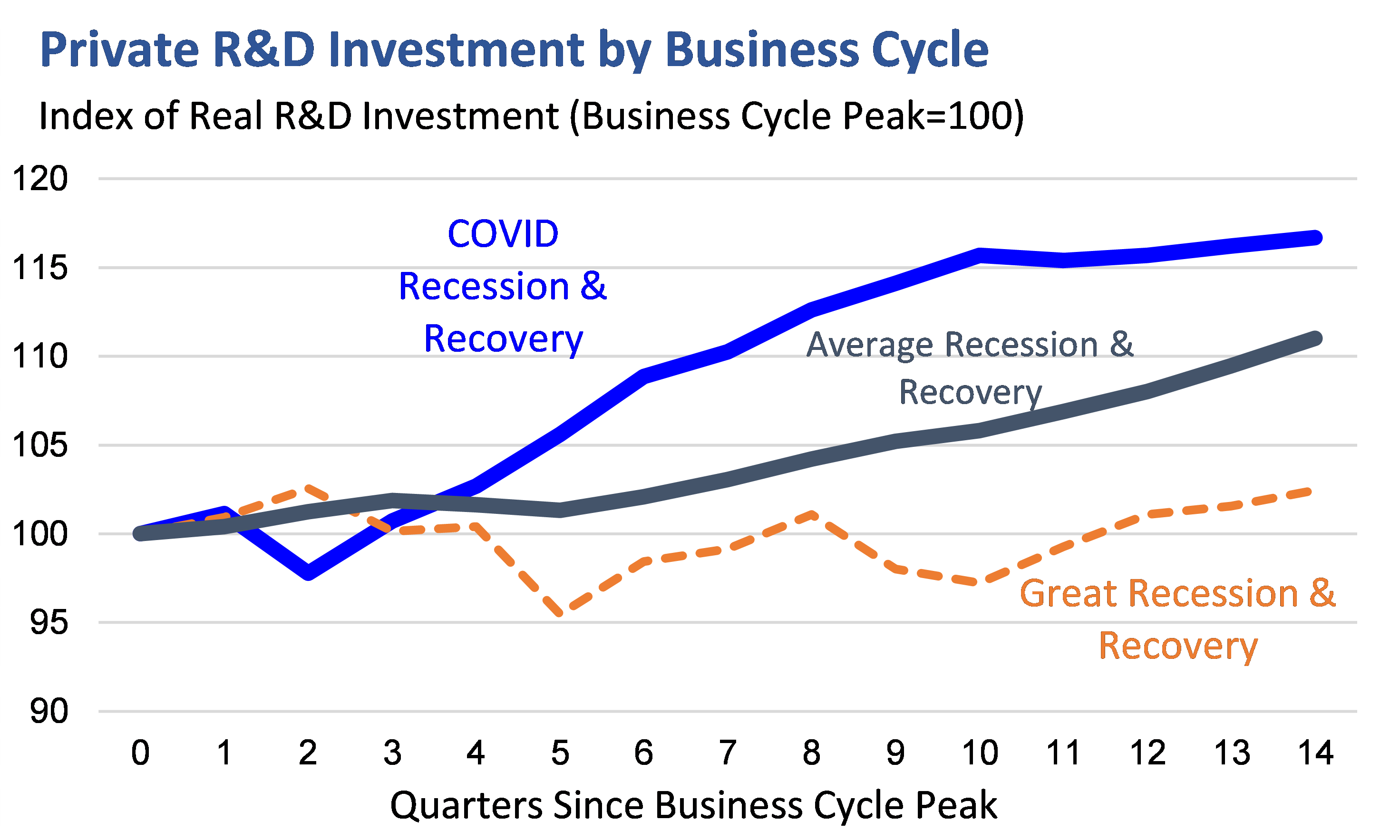

R&D, a very powerful part of BFI, has been sturdy on this restoration (Determine 2). Personal actual R&D funding is 17% upper than when COVID hit; it’s usually most effective 11% upper at this level within the industry cycle. At this level following the Nice Recession, R&D was once most effective 2% upper than ahead of the recession. In fact, many components can assist account for this power. However R&D is precisely such a funding that trendy supply-side economics intends to inspire: investments in new applied sciences that build up our financial system’s long-term expansion.

Determine 2

Supply: Bureau of Financial Research; U.S. Treasury calculations. Actual R&D funding is expressed in billions of chained greenbacks as measured within the Nationwide Source of revenue & Product Accounts, listed to industry cycle peaks as decided by means of the Nationwide Bureau of Financial Analysis. All industry cycle peaks since 1969 are incorporated in “Moderate Recession & Restoration.”

We’re seeing power in industry funding in lots of different sectors as effectively. Through June, actual building of producing amenities had greater than doubled since 2021, basically reflecting new factories within the generation sector (see “Unpacking the Growth in U.S. Development of Production Amenities,” June 27).[2] The CHIPS and Science Act’s important investments in semiconductor production mirror a very powerful contributor to that pattern, simply because the IRA’s incentives for blank tech are any other vital tailwind for industry funding.

Making an investment in Blank Generation in Deprived Communities

The IRA is designed to boost up the advance and deployment of fresh power generation that can permit the USA to do its phase to assist keep away from the disastrous results of local weather trade. However importantly, making such investments in our production sector can build up financial returns for economically deprived or suffering communities when the related process advent happens inside the ones communities. Such investments assist advertise fairness targets by means of elevating wages in lower-wage communities, and there may be proof that funding insurance policies enacted in distressed process markets have the perfect “bang for the dollar.”[3] In truth, for those causes, the IRA contains vital place-based bonuses for finding sure blank power technology investments in low-income and high-unemployment spaces.

It’s too early to check the effectiveness of the place-based incentives throughout the IRA, specifically since some are allotted credit that experience no longer but been awarded. It can be years ahead of now we have the knowledge to verify a complete causal research of the law’s impact on funding. Nonetheless, public reviews of recent investments be offering an early clue of the most likely results and the places the place companies are opting for to speculate. The Biden-Harris Management’s Make investments.Gov web page tracks such bulletins for the reason that President took place of business, together with the positioning of introduced investments and the precise trade sector. Make investments.Gov identifies over 250 tasks reflecting $500 billion in introduced funding; particularly, nearly 150 of the ones tasks, reflecting $200 billion, are in IRA-related sectors of fresh power, electrical cars, and batteries.[4]

Those knowledge are transparent. We discover that counties the place investments in IRA-related sectors were introduced have a tendency to be extra economically deprived than common. We don’t declare that the places of the investments had been selected because of the design of the IRA, and we don’t seem to be making an attempt to spot the explanations in the back of the positioning selection. However without reference to the explanations, the truth that IRA-related investments seem to be concentrated in lower-income puts means that no longer most effective will those investments supply alternative to communities that want it probably the most, however they’re going to additionally leverage probably the most promising areas for nationwide productiveness expansion.[5]

First, IRA-related investments are concentrated in spaces the place faculty commencement charges are not up to common. Determine 3 presentations that greater than 80% of such investments are in counties with decrease faculty commencement charges than the nationwide common.

Determine 3

Supply: Make investments.Gov for funding undertaking places; U.S. Census Bureau for county-level faculty commencement charges; U.S. Treasury calculations. Plotted distributions are histograms reflecting the collection of tasks in each and every of 20 equally-sized buckets by means of faculty commencement fee within the said county. Faculty commencement charges are as of 2021.

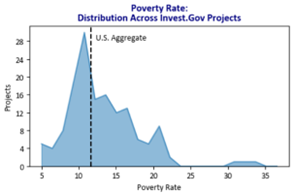

2nd, Determine 4 presentations that about 65% of introduced investments are in counties with above-average general poverty charges. A equivalent proportion of introduced IRA-related investments are in counties with above-average kid poverty charges.

Determine 4

Supply: Make investments.Gov for funding undertaking places; U.S. Census Bureau for county-level poverty charges; U.S. Treasury calculations. Plotted distributions are histograms reflecting the collection of tasks in each and every of 20 equally-sized buckets by means of poverty fee within the said county. Poverty charges are as of 2021.

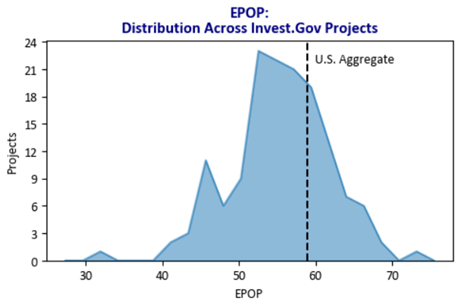

3rd, 65% of introduced investments are in counties the place a lower-than-normal proportion of the inhabitants is hired. Determine 5 plots the ones employment-population (“EPOP”) ratios.

Determine 5

Supply: Make investments.Gov for funding undertaking places; Bureau of Exertions Statistics for county-level employment-population ratios; U.S. Treasury calculations. Plotted distributions are histograms reflecting the collection of tasks in each and every of 20 similarly sized buckets by means of employment-population ratio within the said county. Employment-population ratios are 2022 annual averages. Those knowledge don’t come with one introduced undertaking in Connecticut because of a up to date trade in Connecticut’s Census geographic classifications.

Possibly maximum strikingly, common wages are a lot decrease in counties that experience observed IRA-related funding bulletins. Determine 6 presentations that virtually 90% of the introduced investments are in counties with below-average weekly wages.

Determine 6

Supply: Make investments.Gov for funding undertaking places; Quarterly Census of Employment & Wages for county-level common weekly wages; U.S. Treasury calculations. Plotted distributions are histograms reflecting the collection of tasks in each and every of 20 equally-sized buckets by means of common weekly wages within the said county. Moderate weekly wages are 2022 annual averages.

Those communities are poised to harvest massive advantages from new funding. New crops may convey other people into the exertions drive who’ve been left in the back of. Either one of those results would lead to upper earning for other people in those communities. Moreover, all the nation will take advantage of a extra productive exertions drive related to cleaner generation.

Conclusion

Industry funding has been particularly resilient previously few years, as firms put money into R&D which is helping develop our financial system in the longer term. The Inflation Relief Act encourages those investments in blank generation to assist cut back world carbon emissions. On the similar time that combination funding has higher, reported investments in blank power, electrical cars, and batteries are being deployed in communities with weaker exertions markets and different disadvantages. Those investments in long-term expansion, which might be additionally focused at lowering inequality and addressing local weather trade, are central to fashionable supply-side economics and to President Biden’s schedule.

[1] See, e.g., Patrick Kline and Enrico Moretti, Folks, Puts, and Public Coverage: Some Easy Welfare Economics of Native Financial Construction Systems, Annual Evaluation of Economics 2014 6:1, 629-662.

[2] General Development Spending: Production in the USA (TLMFGCONS) | FRED | St. Louis Fed (stlouisfed.org); Manufacturer Worth Index by means of Commodity: Intermediate Call for by means of Commodity Kind: Fabrics and Elements for Development (WPUID612) | FRED | St. Louis Fed (stlouisfed.org)

[3] Kline and Moretti, 2014; Benjamin Austin, Edward Glaeser, and Lawrence Summers, “Jobs for the Heartland: Position-Based totally Insurance policies in Twenty first-Century The united states,” Brookings Papers on financial Process, Spring 2018, pp. 151-232.

[4] About one-third of the 150 investments in IRA-related sectors had been introduced previous to the passage of the IRA, and, of those, 20 had been made in 2021. We’ve incorporated those investments within the research on this weblog put up as a result of many companies may plausibly have expected the enhanced coverage surroundings for funding beneath this Management because of prior proposals and coverage debates.

[5] Some commentators have argued that the correlation between revenue and placement selection will also be defined by means of investments going on in states with coverage environments much less supportive of unionization than others. Then again, even within the subset of IRA-related investments in states with out “right-to-work” rules, three-quarters of introduced investments have below-average wages and below-average faculty commencement charges—in step with the distributions mentioned right here.

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness