Federal Reserve officers on Wednesday will most likely sign a slower tempo of rate of interest cuts subsequent yr in comparison with the previous few months, which might imply that American citizens may experience most effective slight aid from still-high borrowing prices for mortgages, auto loans and bank cards.

The Fed is about to announce a quarter-point minimize to its benchmark fee, from about 4.6% to kind of 4.3%. The most recent transfer would observe a larger-than-usual half-point fee minimize in September and a quarter-point relief in November.Wednesday’s assembly, despite the fact that, may just mark a shift to a brand new section within the Fed’s insurance policies: As a substitute of a fee minimize at every assembly, the Fed is much more likely to chop at each and every different assembly — at maximum. The central financial institution’s policymakers might sign that they be expecting to cut back their key fee simply two or thrice in 2025, moderately than the 4 fee cuts they’d envisioned 3 months in the past. Tale continues beneath commercial

1:48

Financial institution of Canada cuts charges via half of some extent however indicators ‘extra sluggish’ tempo

To this point, the Fed has defined its strikes via describing them as a “recalibration” of the ultra-high charges that had been supposed to tame inflation, which reached a four-decade excessive in 2022. With inflation now a lot decrease — at 2.3% in October, in keeping with the Fed’s most well-liked gauge, down from a top of seven.2% in June 2022 — many Fed officers argue that rates of interest don’t wish to be so excessive.

Get weekly cash information

Get skilled insights, Q&A on markets, housing, inflation, and private finance knowledge dropped at you each and every Saturday.

However inflation has remained caught above the Fed’s 2% goal in contemporary months whilst the economic system has endured to develop briskly. On Tuesday, the federal government’s per thirty days file on retail gross sales confirmed that American citizens, in particular the ones with upper earning, are nonetheless prepared to spend freely. To a couple analysts, the ones tendencies lift the danger that additional fee cuts may just ship an overly sturdy spice up to the economic system and, in doing so, stay inflation increased.On best of that, President-elect Donald Trump has proposed a variety of tax cuts — on Social Safety advantages, tipped source of revenue and extra time source of revenue — in addition to a scaling-back of rules. Jointly, those strikes may just stimulate enlargement. On the identical time, Trump has threatened to impose plenty of price lists and to hunt mass deportations of migrants, which might boost up inflation. Tale continues beneath commercial

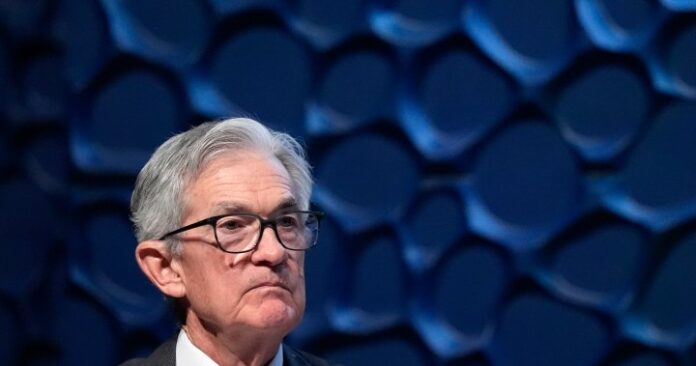

Chair Jerome Powell and different Fed officers have mentioned they gained’t be capable of assess how Trump’s insurance policies may have an effect on the economic system or their very own fee choices till extra main points are made to be had and it turns into clearer how most likely it’s that the president-elect’s proposals will if truth be told be enacted. Till then, the end result of the presidential election has most commonly heightened the uncertainty surrounding the economic system.

Trending Now

Learn Chrystia Freeland’s letter resigning from the Trudeau cupboard

Ottawa shifting forward on automated tax submitting. Right here’s what to understand

Both approach, it sounds as if not likely that American citizens will experience a lot decrease borrowing prices anytime quickly. The common 30-year loan fee used to be 6.6% remaining week, in keeping with loan massive Freddie Mac, beneath the height of seven.8% reached in October 2023. However the kind of 3% loan charges that existed for almost a decade prior to the pandemic aren’t going to go back within the foreseeable long run.

Extra on Global

Extra movies

Fed officers have underscored that they’re slowing their fee discounts as their benchmark fee nears a degree that policymakers consult with as “impartial” — the extent that neither spurs nor hinders the economic system.“Enlargement is for sure more potent than we concept, and inflation is coming in slightly upper,” Powell mentioned lately. “So the excellent news is, we will be able to have enough money to be slightly extra wary as we attempt to in finding impartial.”Maximum different central banks world wide also are chopping their benchmark charges. Final week, the Ecu Central Financial institution diminished its key fee for the fourth time this yr to a few% from 3.25%, as inflation within the 20 international locations that use the euro has fallen to two.3% from a top of 10.6% in overdue 2022. Tale continues beneath commercial

1:55

The place are you able to shuttle when your cash doesn’t pass so far as it used to?

&replica 2024 The Canadian Press

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness