New fairness funding builds on sale of a near-20% stake to Bain Capital to boost up IMS’ expansion and innovation.

SANTA CLARA, Calif.–(BUSINESS WIRE)–

Intel Company nowadays introduced that it has agreed to promote an roughly 10% stake within the IMS Nanofabrication trade (“IMS”) to TSMC. TSMC’s funding values IMS at roughly $4.3 billion, in line with the valuation of the contemporary stake sale to Bain Capital Particular Eventualities (“Bain Capital”). Intel will retain majority possession of IMS, which can proceed to function as a standalone subsidiary underneath the management of CEO Dr. Elmar Platzgummer. The transaction is predicted to near within the fourth quarter of 2023.

This press liberate options multimedia. View the whole liberate right here: https://www.businesswire.com/information/house/20230912608101/en/

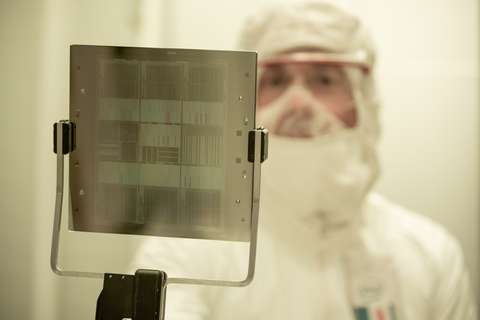

A member of the Intel Masks Operation group in Hillsboro, Oregon, holds a masks utilized in complex lithography equipment to create laptop chips. The masks is created with a multimillion-dollar gadget referred to as a multi-beam masks creator constructed through the Austria-based corporate IMS Nanofabrication, an Intel corporate. (Credit score: Intel Company)

IMS is the established {industry} chief in multi-beam masks writing equipment required to increase complex excessive ultraviolet lithography (EUV), which is extensively followed in modern era nodes that allow probably the most hard computing programs, akin to synthetic intelligence (AI) and cellular. In combination, Bain Capital and TSMC’s investments supply IMS with greater independence and improve self belief within the important alternative forward of IMS. This added autonomy will lend a hand IMS boost up its expansion and pressure the following segment of lithography era innovation to allow the {industry}’s transition into new patterning programs, akin to high-numerical-aperture (high-NA) EUV.

Matt Poirier, senior vp of Company Construction at Intel, stated, “This funding demonstrates the deep {industry} collaboration IMS is pioneering to advance vital lithography era for modern nodes, which can get advantages all of the semiconductor production ecosystem. With enhanced independence, IMS might be neatly located to deal with the numerous expansion alternative for multi-beam masks writing equipment over the following decade and past.”

Platzgummer stated, “We’re extremely joyful to herald new buyers to lend a hand us construct on IMS’ management in multi-beam masks writing, which is the spine of innovation in modern semiconductor applied sciences. It is a testomony to IMS’ experience and management place on this integral era. At the side of our companions, we sit up for proceeding to improve innovation of next-generation applied sciences and ship worth around the semiconductor ecosystem.”

Dr. Kevin Zhang, senior vp of Industry Construction at TSMC, stated, “TSMC has been running with IMS since 2012 at the building of multi-beam masks writers for complex era nodes. This funding continues the long-term partnership between TSMC and IMS to boost up innovation and allow deeper cross-industry collaboration.”

IMS performs a vital function in enabling the expansion and development of the semiconductor {industry} in an technology of ever extra hard programs. World semiconductor call for continues to develop fueled through 5 superpowers: AI, pervasive connectivity, ubiquitous computing, cloud-to-edge infrastructure and sensing. The marketplace is predicted to achieve $1 trillion through 2030. A key enabler of this expansion is advances in lithography era, akin to EUV, which is very important for the modern nodes that allow those hard programs. Those lithographic advances depend on refined masks writing equipment, which make IMS’ management era central to innovation around the ecosystem.

Intel to start with invested in IMS in 2009 and in the end got the rest stakes in 2015. For the reason that acquisition, IMS has delivered a vital go back on funding to Intel whilst rising IMS’ team of workers and manufacturing capability through 4 occasions and turning in 3 further product generations. In June 2023, Intel introduced an settlement to promote an roughly 20% stake in IMS to Bain Capital.

About Intel

Intel (Nasdaq: INTC) is an {industry} chief, growing world-changing era that permits world growth and enriches lives. Impressed through Moore’s Legislation, we frequently paintings to advance the design and production of semiconductors to lend a hand deal with our consumers’ largest demanding situations. Through embedding intelligence within the cloud, community, edge and each and every more or less computing software, we unharness the potential for knowledge to turn into trade and society for the simpler. To be told extra about Intel’s inventions, move to newsroom.intel.com and intel.com.

About IMS Nanofabrication

IMS Nanofabrication World, LLC, a majority-owned subsidiary of Intel Company, is the worldwide era chief for multi-beam masks writers. Its consumers are the most important chip producers on the earth, who depend on its era to supply present and long run chip generations. IMS’ leading edge multi-beam writers play a key function in chip production and supply important added worth to the semiconductor {industry}. They’re regularly custom designed and delicate through an interdisciplinary group, in keeping with the newest marketplace calls for. During the last 10 years, IMS has perfected its electron-based multi-beam era. The primary-generation multi-beam masks creator, MBMW-101, is effectively running far and wide the sector. The second one-generation multi-beam masks creator, MBMW-201, entered the masks creator marketplace within the first quarter of 2019 for the 5nm era node. And this yr, IMS is launching MBMW-301, a fourth-generation multi-beam masks creator that delivers unheard of efficiency. Be informed extra at www.ims.co.at/en/.

Ahead Taking a look Statements

This press liberate comprises ahead having a look statements in regards to the deliberate sale of a minority stake in IMS Nanofabrication World, LLC, (“IMS”) through TSMC Construction, Inc., a subsidiary of Taiwan Semiconductor Production Corporate, Ltd. (“TSMC”), together with the timing of final and conceivable implications of such sale of a portion of the IMS trade. Such ahead having a look statements contain plenty of dangers and uncertainties that might reason precise effects to range materially from the ones expressed or implied, together with: the chance that the transaction might not be finished in a well timed method or in any respect, together with because of a failure to obtain regulatory approvals; the prevalence of any tournament, trade or different circumstance that might give upward push to the termination of the transaction; the chance that the anticipated advantages of the transaction, together with because of the greater independence of IMS, might not be discovered or that the sale of a minority possession in IMS to a competitor of Intel might adversely affect the IMS trade or Intel; disputes or attainable litigation associated with the transaction or the possession, keep watch over and operation of the IMS trade, together with because it pertains to Intel; unanticipated prices associated with the transaction or the IMS trade that can be incurred; dangers as to the retention of key IMS staff and consumers; attainable opposed reactions or adjustments to trade relationships on account of the announcement or finishing touch of the transaction; adjustments in call for for semiconductor production equipment; the excessive degree of festival and speedy technological trade within the semiconductor {industry}; and different dangers and uncertainties described in Intel’s income liberate dated July 27, 2023, 2022 Annual Record on Shape 10-Ok and different filings with the SEC. All data on this press liberate displays Intel control perspectives as of the date hereof except an previous date is specified. Intel does now not adopt, and expressly disclaims any accountability, to replace such statements, whether or not because of new data, new trends, or another way, with the exception of to the level that disclosure is also required through regulation.

© Intel Company. Intel, the Intel emblem and different Intel marks are emblems of Intel Company or its subsidiaries. Different names and types is also claimed as the valuables of others.

View supply model on businesswire.com: https://www.businesswire.com/information/house/20230912608101/en/

Michael Anderson

Investor Family members

1-916-356-7704

michael.d.anderson@intel.com

Sophie Gained

Media Family members

1-408-653-0475

sophie.gained@intel.com

Supply: Intel Company

Launched Sep 12, 2023 • 8:30 AM EDT

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness