Sept 11 (Reuters) – Retail buyers getting their first chew at Arm Holdings’ extremely expected public providing when the British chip fashion designer starts buying and selling this week must beware: particular person traders frequently get burned once they leap on scorching listings.

Arm’s function of elevating round $5 billion in New York in what could be the most important IPO of 2023 follows different primary listings lately whose returns have most commonly disenchanted.

Since Arm, owned by way of Japan’s SoftBank Crew’s (9984.T), isn’t well known amongst shoppers, it’s focusing its IPO advertising and marketing efforts on institutional traders, other folks aware of the deal stated.

That leaves maximum Major Side road traders to shop for Arm stocks at doubtlessly upper costs when they start buying and selling. With retail traders preserving particular person shares for not up to a 12 months on moderate, contemporary historical past suggests they may lose cash, a Reuters research presentations.

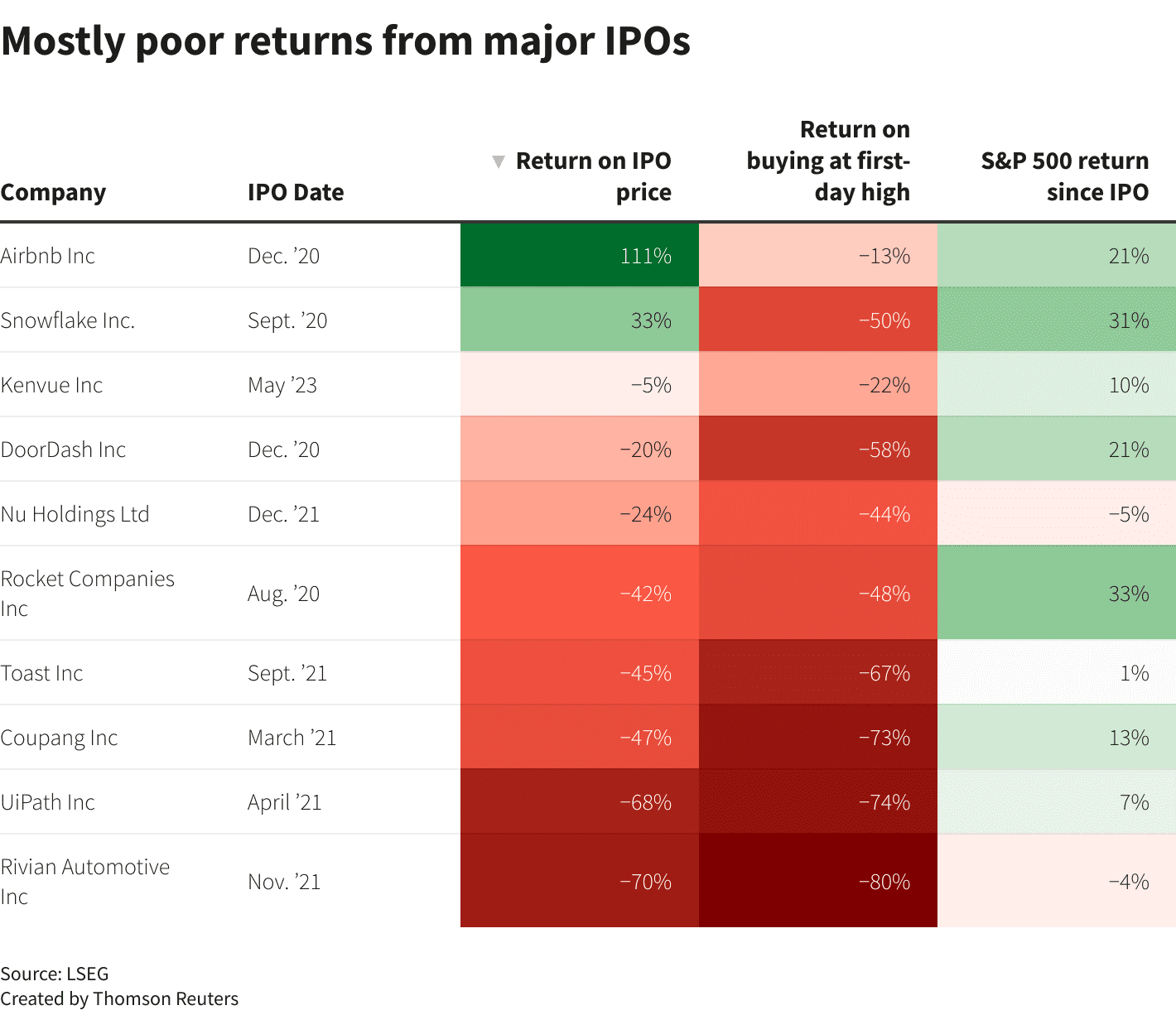

The ten largest U.S. preliminary public choices (IPOs) of the previous 4 years are down a mean of 47% from the final worth on their first day of buying and selling, in step with the research of LSEG knowledge as of Friday. Traders who purchased on the best of an intra-day worth surge that frequently happens in high-profile listings would have fared even worse, with a mean lack of 53%.

Most effective two of the shares in the ones best 10 are up from their IPO costs: tool dealer Snowflake (SNOW.N) and Airbnb (ABNB.O), which leads with a 111% go back.

Whilst dabbling in particular person shares is a notoriously dangerous enterprise for beginner traders, the research underscores simply how perilous it may be to shop for into blockbuster IPOs on Day One.

Even institutional traders invited to shop for into the ones 10 IPOs ahead of buying and selling could be down a mean of 18%.

The S&P 500 (.SPX) has won a mean of 13% since every of the ones IPOs, 9 of which took place in 2020 and 2021.

“If you are purchasing available in the market, on moderate, you might be purchasing at a top class to the be offering worth,” stated Jay Ritter, a professor on the College of Florida who research IPOs. “For the majority retail traders, purchasing and preserving a cheap index fund is the most productive technique.”

Arm’s debut and an upcoming list from grocery supply carrier Instacart are anticipated to rejuvenate a lackluster IPO marketplace which has slowed during the last two years because of volatility and financial uncertainty.

Instacart will likely be providing some retail traders an opportunity to shop for into its IPO by way of underwriter fintech corporate SoFi, its prospectus stated. On Monday, SoFi notified shoppers it might offer a “restricted selection of stocks” within the Arm IPO too.

Whilst Arm is a business-to-business corporate with little shopper logo popularity, its IPO exposure is most probably to draw retail passion, stated analysts. Nvidia (NVDA.O), the chipmaker on the middle of a synthetic intelligence growth, has been a retail favourite this 12 months.

Retail participation in U.S. shares surged in 2021, fueled by way of low rates of interest, zero-cost buying and selling apps, and social media hype round GameStop and different so-called meme shares.

However Major Side road traders have turn out to be extra wary after final 12 months’s inventory marketplace sell-off, stated Marco Iachini, a senior vp at Vanda Analysis, which tracks retail trades.

“No matter comes out of the Arm IPO, you can see niches of the retail neighborhood looking to get in on it, however it isn’t going to be on the ranges we noticed in one of the crucial IPOs in 2021,” he stated.

Spokespeople for Arm and SoFi declined to remark. Spokespeople for Instacart and the ten firms whose IPOs have been analyzed didn’t supply remark, or didn’t reply to remark requests.

CRUSHED VALUATIONS

Arm is looking for as much as $51 according to proportion, doubtlessly valuing it at greater than $50 billion – essentially the most precious corporate to listing in New York since electrical carmaker Rivian Car (RIVN.O) debuted in 2021.

Burning via money to ramp up manufacturing, Rivian’s marketplace worth has collapsed by way of over $60 billion because it indexed. Additionally some of the largest IPOs lately, meals supply corporate DoorDash’s (DASH.N) inventory stays down by way of greater than part from its intraday excessive on its December 2020 debut.

To make sure, it’s been a difficult few years for IPOs. Wall Side road’s steep sell-off in 2022, along side emerging rates of interest and fears of a possible U.S. recession, have beaten valuations of businesses that went public ahead of they have been winning. However research by way of Ritter and others have proven IPOs be offering deficient returns.

Previously 4 years, over 260 IPOs have debuted with inventory marketplace values above $1 billion, most commonly within the era, healthcare and shopper discretionary sectors, in step with LSEG. They’re down on moderate 29% from their providing costs and down 49% from their preliminary buying and selling highs.

One standout amongst contemporary giant IPOs is chipmaker GlobalFoundries (GFS.O), which has won 23% since its 2021 list, in comparison to the S&P 500’s 3% dip over that point.

Further reporting by way of Lance Tupper, Anirban Sen and Echo Wang; modifying by way of Michelle Value and Richard Chang

Our Requirements: The Thomson Reuters Believe Ideas.

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness