Justin Sullivan

Funding Thesis

I imagine United Parcel Provider, Inc. (NYSE:UPS) inventory is these days a grasp. Whilst the corporate has a robust trade fashion and has made strategic investments in era to enhance potency, the temporary monetary outlook is difficult due to macroeconomic components like financial slowdown, excessive hard work prices, and emerging gasoline costs. Personally, the projected 6% CAGR for the following 5 years does not supply a enough margin of protection, particularly when in comparison to the yield of the U.S. 5-year treasury bond, which is over 4%.

Corporate Evaluate

UPS operates in over 220 international locations and gives services and products like package deal supply and provide chain control. It has 3 primary segments: U.S. Home Package deal, Global Package deal, and Provide Chain & Freight. The U.S. Home Package deal specializes in deliveries inside the U.S., whilst the Global Package deal provides world transport choices. The Provide Chain & Freight phase supplies logistics and transportation services and products to companies. In my view, UPS has a well-structured trade fashion that covers each home and world markets. Its Provide Chain & Freight phase provides some other layer of provider, catering to companies that require logistics answers. As for festival, FedEx (FDX) is a key participant that still provides a extensive vary of transport and logistics services and products. Amazon (AMZN) is an rising competitor, specifically because it builds its personal logistics community to beef up its e-commerce operations. Each pose demanding situations to UPS in several facets of the logistics and supply marketplace.

UPS International Scale and Duopoly in Logistics

Personally, UPS’s intensive world community and scale are a very powerful property that give it a aggressive edge within the logistics and package deal supply trade. With operations in over 220 international locations and a powerful infrastructure that features a numerous fleet of cars and airplane, UPS is well-positioned to capitalize on economies of scale. That is specifically recommended for making improvements to value potency and boosting benefit margins. By means of spreading its fastened prices over a big quantity of shipments, UPS can successfully decrease its reasonable value in keeping with package deal, thereby expanding its profitability.

I additionally imagine that the economies of scale create an important barrier to access for brand spanking new competition. The preliminary funding required to succeed in a identical stage of operational potency as UPS can be extraordinarily excessive, making it tricky for brand spanking new entrants to compete successfully.

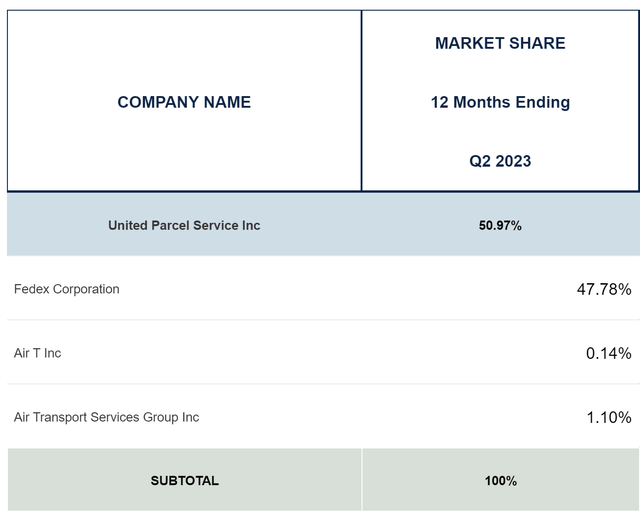

Moreover, in spite of the emergence of Amazon Logistics, the logistics trade stays a near-duopoly between UPS and FedEx as of Q2 2023. UPS holds a commanding 50.97% marketplace proportion within the Shipping & Logistics Business, intently adopted via FedEx with a 47.78% proportion. In combination, they keep an eye on virtually 99% of the marketplace, leaving just one% for smaller competition who in finding it tricky to compare their scale and potency. Individually, this focus of marketplace energy no longer most effective limits price war but additionally permits for extra predictable operational making plans for each UPS and FedEx. The economies of scale loved via UPS additional give a boost to its aggressive place, enabling it to satisfy a various vary of purchaser wishes whilst solidifying its value benefits and boundaries to access. This marketplace dominance underscores the bold aggressive panorama of the logistics sector and highlights the numerous benefits that include UPS’s large-scale operations.

CSI Marketplace

Center of attention on Buyer Loyalty and Technological Investments

Individually, UPS’s emblem power is a important consider its marketplace management, however it isn’t almost about advertising or title popularity. The corporate has earned accept as true with via constant reliability and customer support. As an example, UPS has noticed a gradual build up in its engagement with small and medium-sized companies. As of the latest quarter of 2023, SMBs accounted for 29.6% of UPS’s overall U.S. quantity, marking the eleventh consecutive quarter of expansion on this phase. This implies a robust visitor loyalty that has been constructed over years.

Moreover, UPS is making an investment in era to enhance visitor enjoy. The corporate plans to roll out 1,000 self-service kiosks in its retail outlets via the tip of October 2023, making it more uncomplicated for patrons to regulate shipments and returns. I imagine those don’t seem to be simply beauty adjustments; they are strategic strikes aimed toward improving visitor loyalty. This customer-centric means no longer most effective is helping to retain a devoted visitor base but additionally acts as a aggressive defend in a marketplace the place even minor lapses can ship consumers to competition. General, UPS’s emblem and customer support are key property that strengthen its aggressive place.

Navigating Quick-Time period Monetary Headwinds

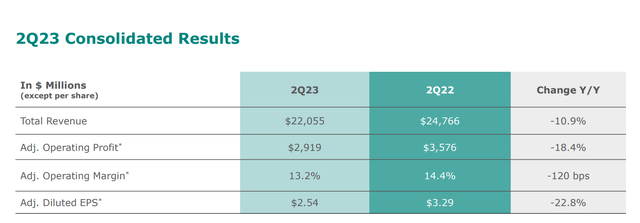

Personally, UPS is dealing with a difficult monetary panorama for the following 12 months, given the new downturn in its key efficiency signs. As of Q2 2023, the corporate’s revenues have declined via 10.9% YoY, adjusted EPS has dropped via 22.8% YoY, and changed running margins have shrunk from 14.4% to 13.2%. I imagine probably the most primary drivers in the back of this decline is the macro-economic slowdown, exacerbated via upper rates of interest and inflation, which has ended in a lower in total financial job.

UPS Q2 2023 Profits Presentation

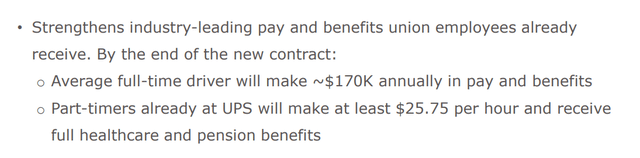

Moreover, I feel the record-high fuel costs are striking further force on running margins, a scenario that does not appear more likely to enhance quickly. Including to those monetary headwinds, UPS’s running margins are anticipated to be additional impacted via a brand new hard work contract. Below this settlement, the typical full-time driving force will earn roughly $170,000 yearly in pay and advantages, whilst part-timers will make no less than $25.75 in keeping with hour and obtain complete healthcare and pension advantages.

UPS Q2 2023 Profits Presentation

Given those hard work prices, at the side of the commercial demanding situations and emerging operational bills, I believe the outlook for UPS’s income over the following yr is somewhat difficult. The corporate will want to tread moderately to care for profitability, whilst additionally staying true to its commitments to customer support and worker well-being.

Lengthy-Time period Margin Growth Amid Financial Demanding situations

Individually, UPS is making strategic strikes to counterbalance its monetary demanding situations via leveraging era to cut back bills, thank you partially to the implementation of its Overall Provider Plan. This plan objectives to decrease operational hours via roughly 10%. Moreover, UPS has applied Community Making plans Equipment to cut back quantity in non-automated structures via 18%, permitting the corporate to near varieties and reduce its operations headcount via 7% YoY. Any other noteworthy effort is the relief of airline block hours via 6.5%. UPS accomplished this via consolidating extra job into its Worldport hub and reducing again on 2d Day Air flights. I imagine that after the present financial headwinds subside, running margins will most probably extend previous earlier ranges which will have to translate into considerably upper income.

UPS Q2 2023 Profits Presentation

Monetary Research

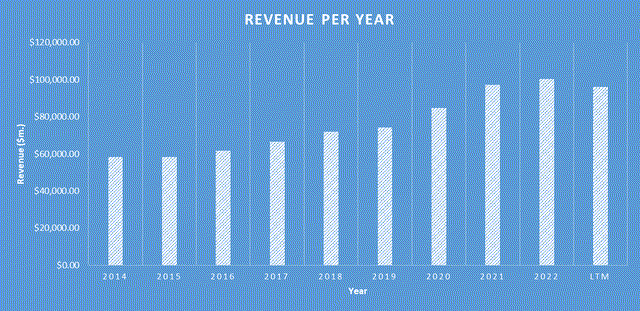

Over the last 5 years, the corporate has demonstrated forged monetary efficiency. Its income has proven a constant and robust expansion, expanding from $71,861.00 million in 2018 to $96,174.00 million within the final three hundred and sixty five days in 2023, representing a compound annual expansion price (CAGR) of roughly 6%. The income in keeping with proportion (EPS) were similarly forged, rising often from $5.51 in 2018 to $11.55 within the final three hundred and sixty five days, reflecting the corporate’s skill to translate income expansion into bottom-line good fortune.

DJTF Investments

As of the latest quarter, the corporate reported money and money equivalents of $7,883.00 million. The corporate’s overall debt stands at $19,024.00 million, a manageable quantity which may be paid off fully with about 3 years’ price of final 12 months loose money glide. The corporate’s present ratio, a measure of its skill to hide temporary liabilities with temporary property, is 1.32, which is in most cases regarded as wholesome as it’s above 1.

As up to now discussed, I be expecting the impending few quarterly income effects to be tricky because of cut back total package deal quantity on account of macro-economic headwinds dampening financial job and better hard work prices and gasoline prices.

Having a look past the following three hundred and sixty five days, assuming a go back to favorable macroeconomic stipulations, the corporate, personally will have to have the ability to extend margins on account of the implementation of the Overall Services and products Plan.

Valuation

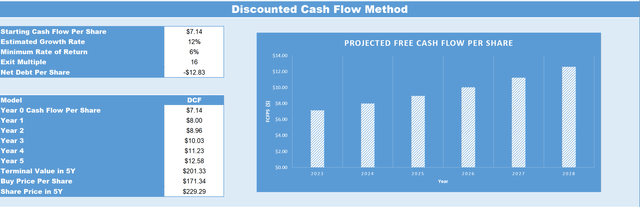

When bearing in mind valuation, I all the time believe what we’re paying for the trade (the marketplace capitalisation) as opposed to what we’re getting (the underlying trade basics and long term income). I imagine a competent approach of measuring what you get as opposed to what you pay is via engaging in a reduced cashflow research of the trade as noticed beneath.

UPS’ present TTM Cashflow in keeping with Percentage as of Q2, 2023 is $7.14. As soon as a beneficial macro setting returns, as money flows normalise and margins extend from the Overall Services and products Plan, I imagine that UPS will have to develop conservatively at 12% yearly for the following 5 years. Due to this fact, as soon as factoring within the expansion price via Q2 2028 UPS’s Cashflow in keeping with Percentage is anticipated to be $12.58. If we then practice an go out more than one of 16, this infers a value goal in 5 years of $229.29. Due to this fact, according to those estimations, if you happen to had been to shop for UPS at lately’s proportion value of $168, this may lead to a CAGR of 6% over the following 5 years.

DJTF Investments

Whilst UPS has a robust trade fashion and is a marketplace chief, I feel investor expectancies are these days too increased for the corporate to supply any form of margin of protection. A projected 6% CAGR over the following 5 years does not appear enough, specifically when the U.S. 5-year treasury bond is yielding over 4%. Given those components, UPS will keep on my watchlist, as I am hoping the marketplace will be offering a extra favorable funding alternative sooner or later.

Conclusion

Personally, UPS stands as an impressive power within the logistics trade, capitalizing on its world scale and near-duopoly with FedEx to succeed in value efficiencies and chase away new festival. I imagine the corporate’s focal point on customer support and technological developments has additional bolstered its emblem, making it a most well-liked selection for a variety of purchasers. Then again, UPS is these days dealing with temporary monetary headwinds because of an financial slowdown, increased hard work prices, and excessive gasoline prices. Whilst the corporate is strategically the use of era to enhance potency, this growth can be felt as soon as the financial system recovers. I feel the projected 6% CAGR over the following 5 years does not be offering a enough margin of protection, specifically when the U.S. 5-year treasury bond is yielding over 4%. Given those components, UPS will stay on my watchlist as I look forward to a extra favorable funding alternative.

#shorts #london #commute

#shorts #london #commute

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness