KE ZHUANG

Funding thesis

Shoals Applied sciences Crew (NASDAQ:SHLS) operates in a promising electric steadiness of machine (EBOS) answers area of interest within the blank power business. The corporate is a marketplace chief on this new business and demonstrates spectacular profitability dynamics in spite of its fairly small scale. That makes the corporate well-positioned to reinvest in innovation and advertising to gasoline competitive earnings expansion. With scaling up, it’s extremely most likely that profitability metrics will extend particularly. In spite of a forged broader marketplace year-to-date rally, SHLS inventory value declined particularly. Whilst my valuation research suggests the inventory trades are on the subject of the honest worth, I believe marketplace leaders with huge expansion attainable will have to industry at a top rate. That mentioned, I assign SHLS a “Purchase” ranking.

Corporate knowledge

Shoals is a number one supplier of EBOS answers and parts for sun, battery garage, and electrical car (EV) charging programs, promoting to consumers essentially within the U.S.

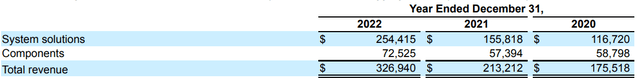

The corporate’s fiscal yr ends on December 31. SHLS disaggregates its earnings from contracts with consumers according to product sort. Earnings through product sort is disaggregated between machine answers and parts. Consistent with the newest 10-Okay file, Device answers earnings represented about 78% of the whole gross sales in FY 2022.

SHLS’s newest 10-Okay file

Financials

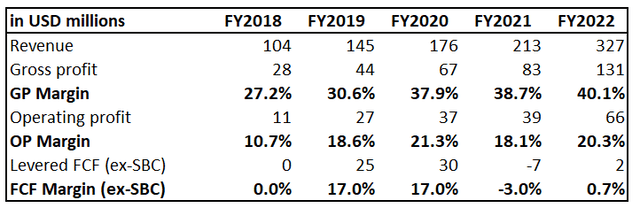

Shoals went public in January 2021, so we now have a fairly quick income historical past to be had. However a five-year duration will have to be enough to look primary tendencies in monetary efficiency. The corporate’s earnings greater than tripled within the final 5 years, which means a 33% CAGR. The gross and running margins stepped forward considerably because the trade scaled up. The unfastened money float (FCF) margin additionally seems to be wholesome, regardless that it’s been unstable over the analyzed duration.

Creator’s calculations

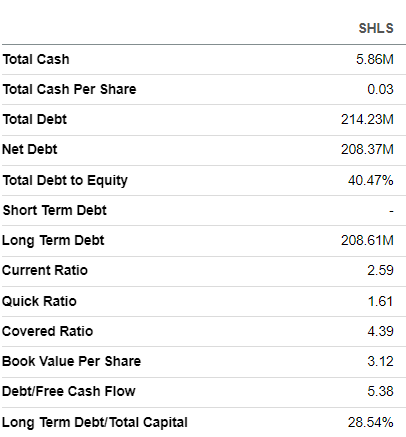

Having forged profitability metrics manner the corporate can take care of a wholesome monetary place. The powerful steadiness sheet has a low leverage ratio and powerful liquidity metrics. SHLS is in a web debt place, regardless that. However I don’t suppose this can be a drawback, since the corporate persistently generates sure FCF, and the lined ratio seems to be comfy at above 4. The corporate does now not pay dividends, and proportion buybacks had been insignificant lately. I believe this is cheap as a result of it might be extra environment friendly to reinvest in innovation to gasoline competitive earnings expansion and seize a extra important marketplace proportion. That mentioned, I don’t be expecting any dividend to be disbursed within the foreseeable long term.

In search of Alpha

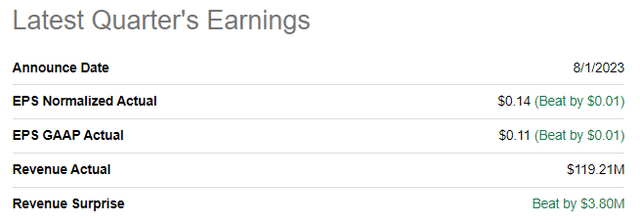

The most recent quarterly income have been launched on August 1, when the corporate crowned consensus estimates. Earnings expansion demonstrated robust momentum, with a staggering 62% YoY build up. The adjusted EPS doubled, which is a forged signal, particularly given low ranges of proportion buybacks. The gross margin expanded from 39% to 42%, and the running margin additionally demonstrated energy through increasing from 18% to 27%. Wider profitability used to be accomplished through a extra favorable earnings combine and enhanced running potency. Shoals ended Q2 with a report $546 million backlog, which is a 67% YoY build up. Throughout the income name, the control reiterated its full-year steerage, which is just right amid the present unsure macro atmosphere. Additionally they shared their imaginative and prescient in regards to the new product pipeline, and I really like that the corporate expands its choices portfolio, which means that extra cross-selling alternatives and better attainable in gaining new consumers.

In search of Alpha

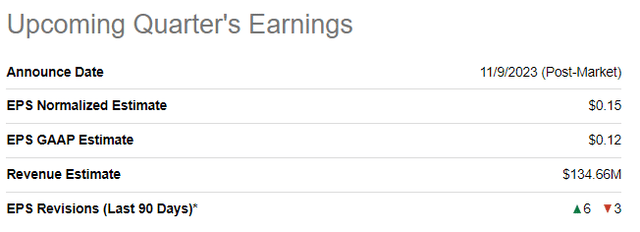

The impending quarter’s income are scheduled on November 9. Earnings is projected through consensus to maintain a stellar expansion price, with an anticipated 48% YoY expansion. The adjusted EPS is anticipated to be in step with earnings expansion and extend from $0.10 to $0.15.

In search of Alpha

Consistent with the newest 10-Okay file, Shoals claims the corporate is considerably greater through earnings than its subsequent biggest competitor. It’s tricky to evaluate as a result of SHLS’s major competition are personal firms, and their monetary knowledge isn’t disclosed. Being the marketplace chief in a promising EBOS marketplace makes Shoals well-positioned to get pleasure from secular tailwinds. The business is anticipated to compound at about 19% CAGR through 2026, which is a bullish signal. The corporate’s forged profitability provides it extra alternatives to reinvest in innovation and advertising. Additionally it is necessary to underline that EBOS is needed for each and every sun, EV charging, or power garage mission without reference to dimension, location, or era. Shoals is main this marketplace on account of its “combine-as-you-go” machine, which allows mission homeowners to put in the apparatus sooner, which means much less prices. Growing actual monetary worth for its consumers makes Shoals a just right spouse for mission homeowners and EPC operators.

SHLS’ newest quarterly income presentation

Bears would possibly argue that the corporate’s era may well be replicated, however Shoals’ highbrow assets may be very properly safe legally through patents. The corporate works exhausting to extend its choices to the EV charging area of interest. Whilst the EV charging business itself has very vivid expansion potentialities because of the speedy EV adoption, we see governmental reinforce to spice up EV adoption, which could also be a forged tailwind for SHLS. Some other primary expansion alternative for Shoals is global growth. The corporate does now not disaggregate its earnings through nation, however monetary statements recommend {that a} important a part of gross sales is generated within the U.S. That mentioned, there’s a huge attainable for earnings expansion if the corporate expands its gross sales across the world. All in all, I’m constructive about Shoals’ expansion potentialities.

Valuation

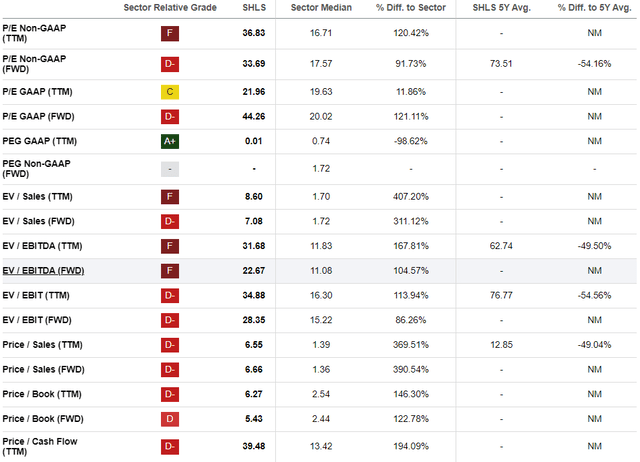

SHLS traders felt ache this yr with a year-to-date 20% inventory value decline, which is considerably worse than the wide marketplace’s dynamic. In search of Alpha Quant assigns the inventory a low “D+” valuation grade as a result of SHLS’s multiples are considerably upper than the field median. Then again, present valuation ratios are a lot not up to the corporate’s historic multiples. Even though, I can’t say the inventory is hyped up according to the multiples, particularly given the earnings expansion profile.

In search of Alpha

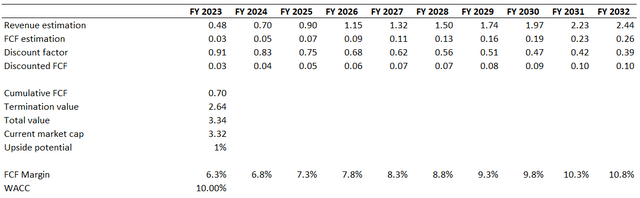

I now need to continue with discounted money float (DCF) way. I exploit a ten% WACC for discounting. I’ve earnings consensus estimates projecting a 20% CAGR for the following decade. I exploit the final 5 years’ moderate FCF margin, which is 6.3%, and be expecting it to extend through 50 foundation issues once a year.

Creator’s calculations

The inventory seems to be somewhat valued, and the trade’s cumulative discounted money float is roughly equivalent to the present marketplace cap. Earnings expansion estimates are competitive at 20% CAGR, so I balanced an constructive earnings expansion profile with a conservative FCF growth. General, I believe the inventory is attractively valued, given the earnings expansion profile and persistently sure FCF margin. Additionally, the most important to say that the present inventory value is considerably not up to the IPO value, which used to be $25 in keeping with proportion.

Dangers to imagine

Shoals basically goal the solar power finish marketplace, which is matter to cyclicality and closely is determined by financial cycles. Financial stipulations within the U.S. at the moment are unsure, with very combined macroeconomic information. Whilst we see that the unemployment price continues to be low and intake seems to be resilient, rates of interest stay emerging, and there’s little proof that the Fed will pivot quickly. That mentioned, there’s a excessive chance that high-interest charges will sooner or later decelerate the economic system, affecting the solar power business as properly. Even though, it’ll be transient and now not secular.

As we now have observed within the “Valuation” phase, very constructive earnings expansion is projected. Consensus estimates forecast that Shoals’ earnings will compound 20% yearly over the following decade, which may be very difficult. In case earnings expansion projections are downgraded, it’ll have a vastly opposed impact at the honest worth. Additionally, even slight quarterly income misses or adjustments to near-term steerage would possibly result in huge volatility. In fresh quarters, we noticed again and again that the inventory value would possibly drop about twenty % intraday even after a moderately disappointing income liberate.

Base line

To conclude, Shoals is a “Purchase” for long-term traders. I really like the corporate’s spectacular profitability dynamic, particularly given the fairly small scale of operations. The present inventory value is on the subject of its honest worth, however I believe marketplace leaders with huge expansion attainable, like Shoals, will have to industry at a top rate to its inventory value.

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness