xijian

Abstract

Following my protection on Portillo’s (NASDAQ:PTLO), which I really helpful a purchase ranking because of my expectation that site visitors will get well ultimately and that there are many alternatives for PTLO to make bigger in the USA. This put up is to offer an replace on my ideas at the trade and inventory. I reiterate my purchase ranking as PTLO SSS efficiency stays robust and there are not any indicators of a slowdown in growing new devices in new markets but. Eating place-level margins [RLM] may well be somewhat depressed now, however it was once because of a positive choice to extend wages to stick aggressive. RLM must support as new devices mature in SSS and productiveness and as COGS traits down.

Funding thesis

Regardless of the inventory worth decline, I believe PTLO delivered robust 2Q23 effects. With a gentle RLM, income larger by way of 12.3%. The 7.1% build up in moderate take a look at dimension, basically because of the 9.9% worth build up, partially offset the decline in site visitors, leading to an SSS this is inside of my anticipated point of “healthiness” of five.9% in comparison to 2Q22’s 1.9%. Although foot site visitors has diminished somewhat because of the fee hike, the whole impact has been sure. I consider the advance in SSS could be extra noticeable if we eradicated one of the most one-offs lately affecting SSS. One instance given by way of control is how the newly opened devices at PLTO impacted SSS by way of 60-80 foundation issues in the second one quarter however are anticipated to go back to commonplace as the corporate ages. Two, there will probably be a non permanent headwind for PTLO because of the normalization of channel combine. As soon as those elements are normalized and the headwind is got rid of, PTLO’s true SSS efficiency will develop into extra obvious.

Regardless of an build up in wages and glued prices, it was once heartening to peer RLM stay quite strong at 25.3%, which have been partly supported by way of a lower in COGS. For the latter, I watch for that PTLO will proceed to peer a decline in enter costs as commodity inflation clears its method towards a slowdown (5.5% commodity in 2Q, a >300bps sequential decline). For the previous (wages), I consider PTLO isn’t like maximum companies which might be “pressured” to extend wages; as a substitute, they have got invested properly in wages early. For my part, this salary funding is worth it as it is helping companies stay their maximum gifted staff, who’re additionally instrumental in making sure clean operations on the retail point. Because of low access obstacles, pageant is fierce within the meals and beverage trade. Virtually all eateries face the ambitious problem of getting to re-hire and re-train body of workers. Subsequently, I believe control’s choice to extend pay with a purpose to care for a aggressive reimbursement package deal (control anticipates seeing exertions inflation within the mid-single digits for FY23). Every other good thing about making early investments and making that reality public is that it is helping to ascertain expectancies for the approaching quarters (traders would kind of know the have an effect on to margin). As COGS eases and PTLO is finished with the rise in wages, we will be expecting to peer RLM additional support from right here – which control could also be vocal about as they be expecting margin growth on a complete 12 months foundation.

On the subject of retailer openings, 8 of the 2023 cohorts are anticipated to occur in 2H23, whilst one will probably be behind schedule till 1Q24. What is maximum necessary to bear in mind is that the hole of latest retail outlets is continuing typically, so there should not be any hiccups of their eventual expansion and, in flip, within the total SSS and RLM. The most productive reaction control may just give to bears who’re nervous about PTLO’s TAM, personally, will be the a success opening of latest devices. I percentage the worry that PTLO would possibly no longer have the ability to effectively export its taste and style throughout the USA, however I do suppose that the execution to this point means that that is conceivable. The approaching September Construction Day might function an extra catalyst in easing this concern.

Valuation

Personal calculation

I consider the honest worth for X in line with my style is $29 for the bottom case and $42 for the bull case. My style assumptions stay the similar as what I’ve assumed in the past, which is in line with control’s long-term expansion steerage of 10+% unit expansion and SSS of low unmarried digits %, resulting in low-teens EBITDA expansion. Assuming this runs via FY27 (the following 5 years), PTLO must generate $154 million in EBITDA in FY27. The query is, at what more than one will PTLO business? I do not need a precise resolution to that, however I consider it must be inside of a variety of 18x to 24x EBITDA.

Friends come with Kura Sushi USA (KRUS), First Watch Eating place Crew (FWRG), Jack within the Field (JACK), Chuy’s Holdings (CHUY), Cheesecake Manufacturing facility (CAKE), Dine Manufacturers World (DIN), BJ’s Eating places (BJRI), Brinker Global (EAT), Bloomin’ Manufacturers (BLMN), and Cannae Holdings (CNNE). The median ahead EBITDA more than one friends are buying and selling at is 9.2x, the anticipated 1Y expansion fee is 5%, and the anticipated 1Y EBITDA expansion fee is -8%.

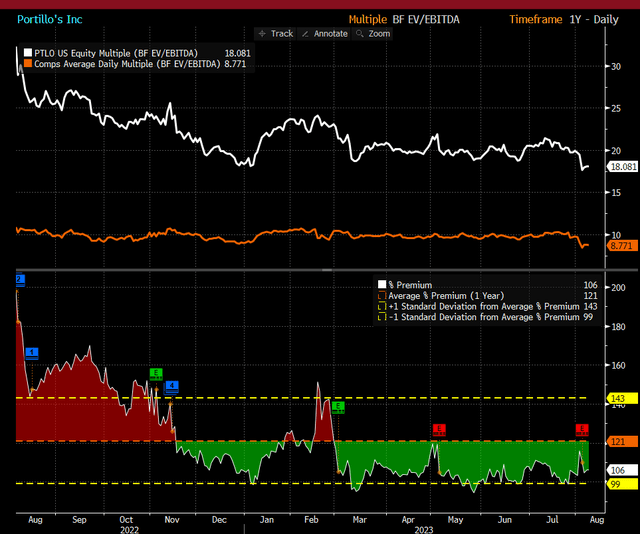

I consider PTLO merits to business at an enormous top rate to friends because it has a fair-to-good expansion profile of 18% and EBITDA expansion of 59%. This has been the case traditionally as smartly. PTLO is now buying and selling at 18x ahead EBITDA, and I be expecting it to no less than business at this point within the close to time period. Then again, if we take a look at it traditionally, PTLO has a mean 2-year ahead EBITDA more than one of 24x. I used the 2-year ahead as it displays marketplace expectancies of normalized profits post-COVID all over FY21/22. If the marketplace rerates PTLO again to its historic moderate, the upside is upper.

Bloomberg

Conclusion

I reaffirm my purchase ranking for PTLO. Regardless of a dip in percentage worth, the trade stays powerful with wholesome SSS efficiency and a strategic center of attention on increasing in the USA. PTLO’s stable RLM, income expansion, and efficient control of demanding situations reminiscent of salary will increase and COGS fluctuations reveal its resilience. The normalization of things impacting SSS and ramping up of latest devices must lend a hand with RLM development. Making an allowance for its awesome expansion profile and EBITDA growth in comparison to friends, PTLO merits a top rate valuation.

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness