UK avoids stagnation with 0.2% enlargement in Q2

Newsflash: The United Kingdom financial system has posted modest enlargement in the second one quarter of this yr, defy fears of stagnation.

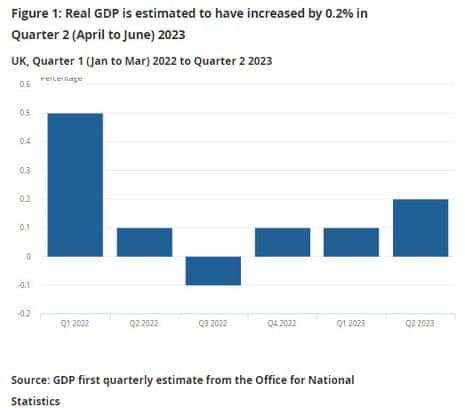

UK GDP expanded by way of 0.2% in April-June, the Place of work for Nationwide Statistics reviews, beating forecasts of no enlargement within the quarter. This follows enlargement of 0.1% in January-March.

In June, the financial system additionally fared higher than anticipated — with enlargement of 0.5%.

That follows the GDP fall of 0.1% in Might, and enlargement of 0.2% in April.

The ONS explains:

In output phrases, the products and services sector grew by way of 0.1% at the quarter, pushed by way of will increase in knowledge and verbal exchange, lodging and meals carrier actions, and human well being and social paintings actions; in different places, the manufacturing sector grew by way of 0.7%, with 1.6% enlargement in production.

In expenditure phrases, there used to be sturdy enlargement in family intake and executive intake, which used to be in part offset by way of a fall in global business flows in the second one quarter.

Key occasions

Sterling strengthens after GDP document beats forecasts

The pound has reinforced, leaping nearly part a cent to $1.272 in opposition to the USA buck.

June’s stronger-than-expected enlargement appears like “the primary certain marvel in a longer term of monetary plot twists”, says Joseph Calnan, company FX dealing supervisor at Moneycorp:

Calnan explains:

Then again, each GDP and inflation are nonetheless off the place they wish to be, with the Financial institution of England and executive policymakers obviously suffering to ship on their respective remits.

“The thornier query is what this will likely imply for rates of interest. What the BoE has been searching for in its relentless marketing campaign of back-to-back rate of interest hikes is a significant slowdown within the financial system, and this doesn’t hit that temporary.

“In spite of the backdrop of spiralling salary enlargement and a scorching labour marketplace; it’s conceivable the 25 bps price upward push forecast on the subsequent MPC assembly will stay. However, because the previous few months have proven us, you’ll be able to by no means make certain which method the following set of monetary signs will move.”

This morning’s UK GDP document is more potent than anticipated:

UK GDP beats forecasts

GDP yr on yr to June

Exact 0.9%

Forecast 0.5%

Earlier -0.4%Yr on Yr for Q2

Exact 0.4%

Forecast 0.2%

Earlier 0.2%Quarter on Quarter for Q2

Exact 0.2%

Forecast 0.0%

Earlier 0.1%Month on Month to June

Exact 0.5%

Forecast 0.2%…— Justin Waite (@SharePickers) August 11, 2023

ONS: Financial system bounced again from Might’s additional financial institution vacation

ONS director of monetary statistics Darren Morgan says there used to be “specifically buoyant enlargement” in the United Kingdom’s car-making sector in June, and in addition within the pharma sector:

“The financial system bounced again from the results of Might’s additional financial institution vacation to checklist sturdy enlargement in June. Production noticed a specifically sturdy month with each automobiles and the often-erratic pharmaceutical business seeing specifically buoyant enlargement.

“Services and products additionally had a robust month with publishing and vehicle gross sales and criminal products and services all doing neatly, regardless that this used to be in part offset by way of falls in well being, which used to be hit by way of additional strike motion.

“Building additionally grew strongly, as did pubs and eating places, with each aided by way of the new climate.”

Per 30 days UK GDP is now estimated to be 0.8% above its pre-Covid-19 ranges, following the 0.5% enlargement reported in June this morning.

A variety of companies cited the extra financial institution vacation in Might as a explanation why for higher output in June when put next with Might, the ONS says.

A breakdown of these days’s GDP document presentations that manufacturing (which incorporates production) grew by way of 1.8%, and used to be the principle contributor to enlargement in per month GDP in June.

The United Kingdom’s dominant carrier sector grew by way of 0.2% in June, whilst building expanded by way of 1.6%.

The United Kingdom financial system grew at its quickest tempo in over a yr within the ultimate quarter, consistent with these days’s GDP document.

It has now grown for the ultimate 3 quarters in a row, as this chart presentations:

Enlargement has been modest – with the financial system increasing by way of simply 0.1% in October-December and January-March, sooner than selecting up in April-June. That’s vulnerable by way of historical requirements.

However thankfully, the recession feared ultimate yr has no longer materialised, but anyway.

UK avoids stagnation with 0.2% enlargement in Q2

Newsflash: The United Kingdom financial system has posted modest enlargement in the second one quarter of this yr, defy fears of stagnation.

UK GDP expanded by way of 0.2% in April-June, the Place of work for Nationwide Statistics reviews, beating forecasts of no enlargement within the quarter. This follows enlargement of 0.1% in January-March.

In June, the financial system additionally fared higher than anticipated — with enlargement of 0.5%.

That follows the GDP fall of 0.1% in Might, and enlargement of 0.2% in April.

The ONS explains:

In output phrases, the products and services sector grew by way of 0.1% at the quarter, pushed by way of will increase in knowledge and verbal exchange, lodging and meals carrier actions, and human well being and social paintings actions; in different places, the manufacturing sector grew by way of 0.7%, with 1.6% enlargement in production.

In expenditure phrases, there used to be sturdy enlargement in family intake and executive intake, which used to be in part offset by way of a fall in global business flows in the second one quarter.

Simply 5 mins to head till we get the United Kingdom financial system’s document card for the second one quarter of the yr…

A trio of financial institution vacations in Might harm task within the production and building sectors as employees loved the additional days off, issues out Victoria Student, head of funding at interactive investor.

However that are supposed to additionally supply a “back-to-work spice up for the financial system” in June, she explains, including:

Consistent with June’s retail gross sales figures, the record-breaking heatwave supported gross sales in supermarkets and division retail outlets, in part pushed by way of prime inflation which flattered meals gross sales, lifted by way of upper costs quite than more potent volumes. Decrease gas costs as opposed to ultimate yr all the way through the power disaster also are most likely to offer a tailwind to gas gross sales and in flip June’s enlargement determine.

Then again, the boiling scorching temperatures are prone to have dampened productiveness, specifically in agriculture and building. In addition they brought about issues within the delivery sector with passengers on trains and planes dealing with delays and cancellations.

The United Kingdom financial system most likely stalled in the second one quarter because of carry-over weak spot from moves and a drag from Might’s additional financial institution vacation, Bloomberg Economics are expecting.

Bloomberg provides:

GDP is observed registering 0 enlargement quarter on quarter and increasing 0.2% yr on yr.

For this quarter, BE forecasts a acquire of 0.1% however that’s most likely the ultimate certain information for some time: Prime rates of interest are anticipated to tip the financial system into recession later in 2023.

Advent: UK GDP in focal point

Excellent morning.

We’re about to find how the United Kingdom financial system fared over the spring and early summer season, within the face of emerging rates of interest and the price of residing disaster.

The Place of work for Nationwide Statistics will liberate its first estimate of UK GDP for the second one quarter of 2023, and only for June, at 7am.

Economists worry the financial system stagnated in Q2, and not using a enlargement, after the meagre 0.1% enlargement recorded in January-March.

In June by myself, Town analysts predict to peer enlargement of 0.2%, a modest restoration after the 0.1% contraction in Might.

Task in Might used to be disrupted by way of the additional financial institution vacation for King Charles’s coronation, so June may just see a restoration in task when put next.

Adam Cole of RBC Capital Markets explains:

Although there used to be an additional financial institution vacation in Might for the Coronation, the affect of that looks to were lower than the affect of an identical further public vacations in 2022. Additionally, a restoration in task from moves the former month helped compensate.

This is prone to opposite once more in June which can drag on task and act as a counterweight to a average restoration in task in June from the affect of Might’s additional financial institution vacation.

Michael Hewson of CMC Markets reckons the forecasts for stagnation in Q2 are too pessimistic.

Having eked out 0.1% enlargement in Q1 of this yr, these days’s UK Q2 GDP numbers ought to turn an development at the earlier two quarters for the United Kingdom financial system, but for some explanation why maximum forecasts are for 0 enlargement.

That turns out unduly pessimistic to me, even supposing the general public sector strike motion is prone to were a drag on financial task.

Opposite to numerous expectancies financial task has controlled to carry up quite neatly, in spite of hovering inflation which has weighed on call for, and particularly at the extra discretionary spaces of the United Kingdom financial system.

The knowledge is launched at 7am UK time…

UK corporations posting profits these days – Beazley, Soho Area – Financial knowledge – UK Stability of Industry, UK GDP, UK Index of Services and products, UK Business Manufacturing & Production Output, US PPI, US College of Michigan Client Self assurance.

— David Buik (@truemagic68) August 11, 2023

The schedule

-

7am BST: UK GDP document for Q2 2023, and for June

-

7am BST: UK business document for June

-

9am BST: IEA per month oil document

-

1.30pm BST: US PPI index of manufacturer costs

-

3pm BST: College of Michigan Index of Client Expectation

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness