Editor’s word: In the hunt for Alpha is proud to welcome Lights Rock Analysis as a brand new contributor. It is simple to change into a In the hunt for Alpha contributor and earn cash on your highest funding concepts. Lively members additionally get unfastened get admission to to SA Top class. Click on right here to determine extra »

Wipada Wipawin

I consider Aon (NYSE:AON) is a extremely ordinary and well-managed corporate, with mid-single-digit natural earnings enlargement and double-digit EPS enlargement, accompanied by way of considerable proportion repurchases. Aon’s United enterprise style has confirmed to be efficient and has delivered sustainable enlargement. Moreover, Aon is coming into upper enlargement spaces similar to local weather, highbrow belongings, and cybersecurity, which might probably boost up their natural earnings enlargement and margin enlargement. I’ve owned Aon for a very long time, and I’m somewhat bullish about their long run enlargement.

Industry Evaluation

Aon serves as a company possibility control and well being and wealth answers supplier. Aon encompasses 4 major enterprise strains:

Business Possibility Answers (54% of earnings): Aon gives possibility consulting and retail brokerage services and products to company shoppers. They earn each insurance coverage commissions {and professional} carrier charges.

Reinsurance Answers (18% of earnings): This contains treaty and facultative insurance coverage services and products for insurance coverage corporations. Aon is servicing insurance coverage corporations.

Well being Answers (17% of earnings): Human capital and worker receive advantages services and products, comparable to the Business Possibility Answers enterprise, producing insurance coverage commissions and repair charges.

Wealth Answers (11% of earnings): Aon supplies retirement consulting and pension management, providing a extremely ordinary and dependable earnings movement.

All 4 companies are predominantly ordinary and non-discretionary. Aon boasts an excellent reasonable retention price of 95% throughout its product portfolios. Even right through the difficult yr of 2009, Aon skilled just a marginal 1% decline in natural earnings.

The control staff targets for a 5% natural earnings enlargement in the long run and foresees reasonable margin enlargement pushed by way of operational potency and the creation of latest services and products. Moreover, Aon expects double-digit enlargement in unfastened money drift over the longer term.

Funding Thesis

Neatly-Controlled Aon United Industry Type

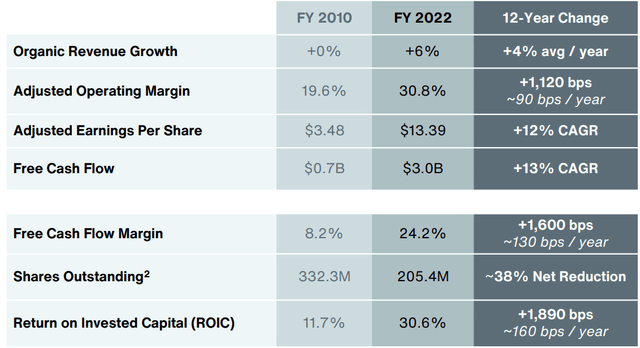

Aon has coined its enterprise style as Aon United, emphasizing standardized running insurance policies and disciplined prioritization. This manner has made Aon extra environment friendly, fostered innovation, and facilitated knowledgeable enterprise selections. In consequence, Aon has accomplished exceptional monetary effects since 2010, witnessing speeded up enlargement in each top-line and bottom-line efficiency. Their unfastened money drift exhibited an excellent compound annual enlargement price of 13% from FY10 to FY22.

Aon Investor Presentation in June 2023

Top Habitual Industry Type

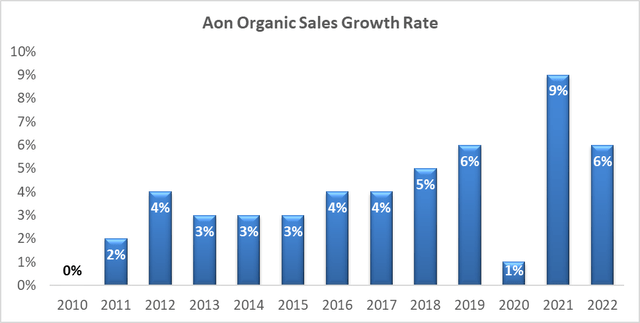

As depicted within the chart beneath, Aon has constantly maintained sure natural gross sales enlargement since 2010, attributed to their extremely ordinary enterprise fashions.

Aon 10Ks, Writer’s Calculation

I feel the resilient enterprise is easy to understand. As an example, inside of their Well being Answers enterprise, Aon assists company purchasers in managing worker well being receive advantages methods. Transitioning from one carrier supplier to every other would most probably contain important migration prices for firms. Moreover, lots of the services and products Aon supplies are necessary for firms, given the requirement to acquire more than a few insurance coverage merchandise to mitigate business-related dangers.

Powerful Capital Allocation Coverage

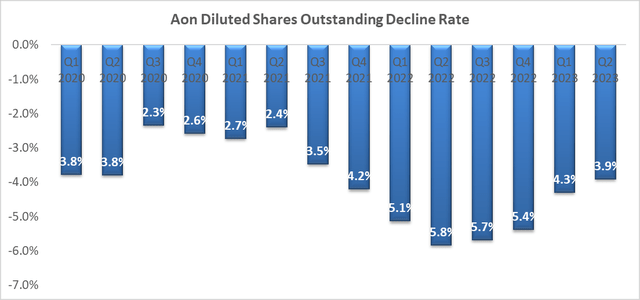

I love Aon’s capital allocation coverage. Over the last 5 years, Aon generated $10.7 billion in unfastened money drift, distributing $2.1 billion in dividends and repurchasing just about $12 billion value of their very own stocks. Naturally, this required taking over some money owed to fund the considerable proportion buybacks. On account of those important repurchases, Aon’s exceptional stocks have constantly reduced quarter after quarter.

Aon Quarterly Effects

Primary Marketplace Misconceptions

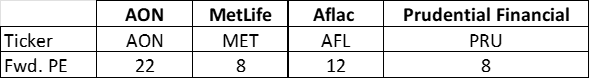

One important false impression prevalent available in the market is viewing Aon only as an insurance coverage corporate. Alternatively, Aon is distinct from conventional insurance coverage corporations because it does no longer endure insurance coverage underwriting dangers. Additionally, Aon derives earnings from each insurance coverage commissions {and professional} services and products. I feel a comparability of ahead P/E ratios between Aon and a few insurance coverage corporations can also be deceptive, as evaluating multiples throughout corporations, particularly the ones in various industries, isn’t an instantaneous comparability.

In the hunt for Alpha Knowledge – Writer’s Calculation

I consider it’s invalid to suppose that Aon must be traded on the identical more than one as different insurance coverage corporations, as this would probably underestimate Aon’s honest worth. In response to my research, Aon’s enterprise style does not only revolve round producing insurance coverage commissions; slightly, they supply complete possibility consulting services and products to enterprises. I consider their number one worth proposition stems from their profound experience in possibility control and mitigation.

Key Funding Dangers

At the entire, I understand Aon to be rather unfastened from considerable dangers of their enterprise operations. However, traders must track a couple of key components.

At the beginning, considerations persist referring to Aon’s running margin. Aon has increased its running margin from 19.6% in FY10 to 30.8% in FY22. The higher prohibit of margin enlargement stays unsure. I consider that if Aon sustains mid-single-digit natural gross sales enlargement and continues product innovation, they may be able to proceed margin enlargement. The expansion price of running bills needn’t replicate earnings enlargement. Additionally, Aon’s foray into local weather, highbrow belongings, cybersecurity, and team of workers resilience companies may just give a contribution to margin enlargement because of the upper pricing related to those services and products.

Secondly, Aon has a historical past of pursuing important M&A transactions. Whilst Aon introduced plans in March 2020 to merge with Willis Towers Watson (WLTW) and create the most important insurance coverage dealer, this $30 billion merger was once in the end deserted because of executive intervention. Such massive transactions may just probably erode shareholder worth if integration proves difficult.

Finally, Aon’s profits may well be suffering from insurance coverage underwriting cycles. Despite the fact that Aon isn’t an insurance coverage corporate and isn’t uncovered to insurance coverage underwriting dangers, I consider {that a} portion in their profits ((in particular insurance coverage commissions)) may well be related to the full underwriting cycles of the insurance coverage marketplace.

Q2 FY23 Profits Assessment

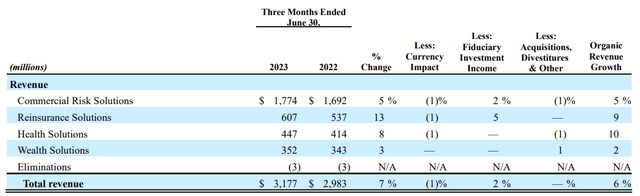

In Q2 FY23, Aon accomplished 6% natural gross sales enlargement and a 110 foundation level margin enlargement. They repurchased 1.7 million magnificence A peculiar stocks right through the quarter, resulting in a three.9% aid in exceptional stocks yr over yr. All over the profits name, Aon’s control indicated that they believe their inventory worth considerably undervalued at its present stage.

Aon Q2 FY23 Incomes Liberate

In Q2 FY23, Aon issued the next steering

- Natural Gross sales enlargement: mid-single-digit in FY23

- Working Margin: be expecting to amplify in FY23

- FCF: double-digit enlargement in FY23

- Capex: reasonable in 2H, and mission $220 million to $250 million in FY23

I feel it was once a somewhat commonplace quarter for Aon. As the corporate disclosed of their profits name, money from operations was once flat yr over yr, and FCF dropped by way of 7%, basically pushed by way of larger capital expenditures. Aon expects their capex to reasonable in the second one part of FY23. In regards to the steadiness sheet, Aon’s control staff indicated that they are going to upload incremental debt as EBITDA grows over the years whilst keeping up the funding credit score profile. For the reason that Aon is repurchasing their stocks, I consider it is smart so as to add some debt to finance the proportion repurchase. As they disclosed, their long-term debt is all fixed-rate with a median of four% and an approximate adulthood time period of eleven years. Subsequently, I believe their steadiness sheet somewhat forged, and the debt seems to be totally manageable.

Aon – DCF Valuation

My DCF valuation style depends on the next assumptions:

Normalized Natural Gross sales Expansion: 5%. Aon’s steering signifies mid-single-digit natural earnings enlargement in the end.

Margin Enlargement: Annual enlargement of 10 to twenty foundation issues. Aon seeks to extend margins over the years, basically via operational leverage and better pricing for brand new merchandise.

Capex: I be expecting $226 million in FY23, intently aligned with their steering. Aon is a capital gentle enterprise, and their capex is representing not up to 2% of general gross sales.

M&A: I suppose a 1% enlargement in gross sales from acquisitions, given Aon’s historical past of incorporating tuck-in acquisitions to amplify its product choices.

Tax Charge: 18%. This represents the common tax price during the last 5 years.

WACC

Beta: 0.83. Knowledge Supply: In the hunt for Alpha’s 24-month beta.

Possibility-Loose Charge of Go back: 4%. I’m the use of 10-year US executive bond yield.

Anticipated Marketplace Go back Top class: 7%. I’m the use of the similar assumption throughout my fashions.

Value of debt: 10%. I’m the use of the similar assumption throughout my fashions.

With those inputs, WACC is calculated at 8.4% in my style.

The desk beneath supplies a abstract of my DCF research.

Aon DCF Type

Consistent with my style, unfastened money drift margin is expected to amplify to twenty-eight.5% in FY32, accompanied by way of double-digit enlargement in EPS. After discounting all company unfastened money flows to offer worth, my estimate puts Aon’s undertaking worth at $89.5 billion, with fairness worth at $80 billion. This means an excellent worth of $392 consistent with proportion in keeping with my estimations.

Conclusion

Aon’s enterprise technique stays secure and constant. Any corporate showcasing mid-single-digit natural earnings enlargement and double-digit EPS enlargement, whilst keeping up a loss of structural dangers, holds sturdy enchantment to me. Aon has been a longstanding part of my funding portfolio, and I wholeheartedly counsel a “Sturdy Purchase” ranking for Aon.

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness