If we need to discover a attainable multi-bagger, ceaselessly there are underlying traits that may give clues. Among different issues, we will need to see two issues; initially, a rising go back on capital hired (ROCE) and secondly, a spread within the corporate’s quantity of capital hired. This displays us that it is a compounding gadget, in a position to repeatedly reinvest its profits again into the industry and generate upper returns. Alternatively, after in short having a look over the numbers, we do not suppose 5 Underneath (NASDAQ:FIVE) has the makings of a multi-bagger going ahead, however let’s take a look at why that can be.

Go back On Capital Hired (ROCE): What Is It?

For many who do not know, ROCE is a measure of an organization’s once a year pre-tax benefit (its go back), relative to the capital hired within the industry. The components for this calculation on 5 Underneath is:

Go back on Capital Hired = Profits Ahead of Hobby and Tax (EBIT) ÷ (Overall Property – Present Liabilities)

0.12 = US$345m ÷ (US$3.4b – US$619m) (In accordance with the trailing one year to April 2023).

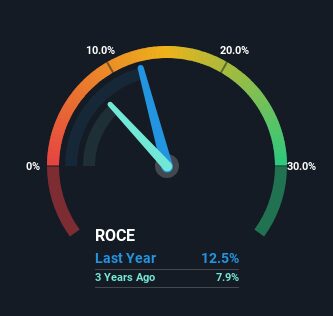

So, 5 Underneath has an ROCE of 12%. That is a rather standard go back on capital, and it is across the 13% generated via the Strong point Retail business.

View our newest research for 5 Underneath

Above you’ll be able to see how the present ROCE for 5 Underneath compares to its prior returns on capital, however there may be best such a lot you’ll be able to inform from the previous. If you would like to peer what analysts are forecasting going ahead, you must take a look at our unfastened file for 5 Underneath.

So How Is 5 Underneath’s ROCE Trending?

At the floor, the fashion of ROCE at 5 Underneath does not encourage self belief. Round 5 years in the past the returns on capital had been 30%, however since then they have got fallen to twelve%. In the meantime, the industry is using extra capital however this hasn’t moved the needle a lot with regards to gross sales prior to now one year, so this may replicate long term investments. It is value keeping track of the corporate’s profits from right here on to peer if those investments do finally end up contributing to the base line.

In Conclusion…

In abstract, 5 Underneath is reinvesting finances again into the industry for expansion however sadly it looks as if gross sales have not higher a lot simply but. Because the inventory has won an excellent 87% during the last 5 years, traders will have to suppose there may be higher issues to come back. In the end, if the underlying traits persist, we would not dangle our breath on it being a multi-bagger going ahead.

If you are nonetheless serious about 5 Underneath it is value testing our FREE intrinsic price approximation to peer if it is buying and selling at a wonderful fee in different respects.

If you wish to seek for cast corporations with nice profits, take a look at this unfastened listing of businesses with just right steadiness sheets and bold returns on fairness.

Have comments in this article? Involved concerning the content material? Get involved with us at once. On the other hand, e mail editorial-team (at) simplywallst.com.

This newsletter via Merely Wall St is common in nature. We offer remark in keeping with historic information and analyst forecasts best the usage of an independent method and our articles aren’t meant to be monetary recommendation. It does no longer represent a advice to shop for or promote any inventory, and does no longer take account of your targets, or your monetary scenario. We goal to deliver you long-term centered research pushed via basic information. Be aware that our research won’t think about the most recent price-sensitive corporate bulletins or qualitative subject material. Merely Wall St has no place in any shares discussed.

| Indonesia Go back and forth Video

| Indonesia Go back and forth Video

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness