nathaphat

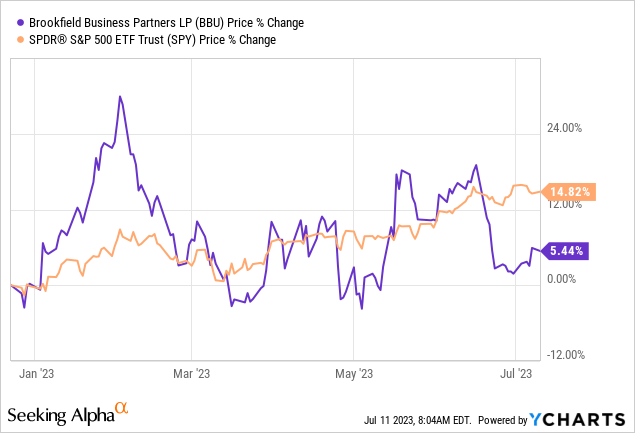

It’s more uncomplicated to get the longer-term outlook on a inventory proper than to pick each height and valley in the associated fee motion. However even the previous calls for periodic follow-ups to verify the direction has no longer modified. Brookfield Trade Companions L.P. (NYSE:BBU) (TSX:BBU.UN:CA), is without a doubt one that we’ve were given the long term proper. Whilst the general public has been enamored with the Brookfield Company (BN) affiliation and the non-public fairness like setup, we noticed this as a less-than-ideal setup. Remaining December, we highlighted as soon as once more how BBU saved disappointing its traders. The inventory took off simply after that replace, however since then has given up 80% of height good points.

We cross over the Q1-2023 effects and spotlight what demanding situations are prone to weigh at the corporate for the remainder of 2023.

Q1-2023

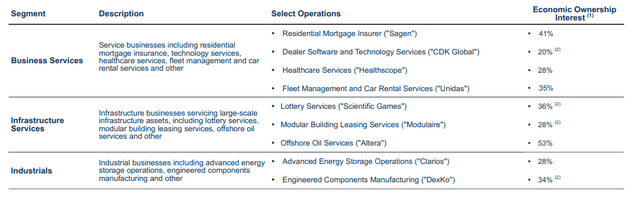

BBU is an amalgamation of many companies, and the composite image is generally arduous to assimilate.

BBU Q1-2023 Presentation

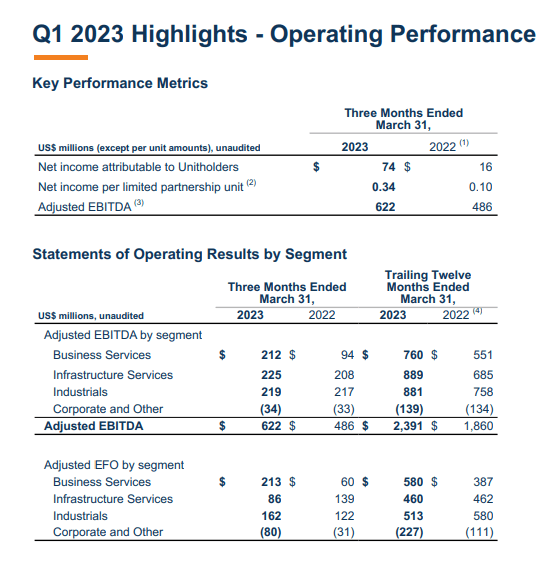

At the widest and maximum beneficiant metric available in the market, although (adjusted EBITDA), issues seemed fairly rosy for the corporate.

BBU Q1-2023 Presentation

Adjusted EBITDA used to be up throughout all traces and rose 28% 12 months over 12 months. The corporate’s personal secondary metric adjusted EFO did lovely neatly too, although it used to be down sharply within the infrastructure phase. The only luxurious the marketplace provides firms like BBU is that they are able to center of attention on extra lenient metrics like Adjusted EBITDA and Adjusted EFO. Those usually have a low stage of bearing for many different conglomerates, which flip their consideration to profits in step with proportion. On that profits entrance, we see that BBU usually does no longer generate a lot on a constant foundation and best creates a significant quantity when there’s an asset sale.

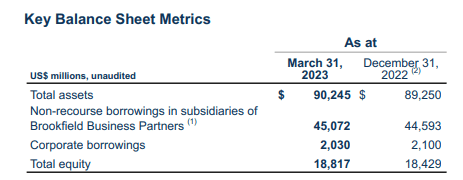

Stability Sheet

A key reason why right here to forget about the adjusted EBITDA numbers is as a result of they after all exclude the “I” which is pastime. BBU’s steadiness is fairly levered up, and you’ll see this via glancing on the consolidated general belongings to general fairness ratio drawing near 5X.

BBU Q1-2023 Presentation

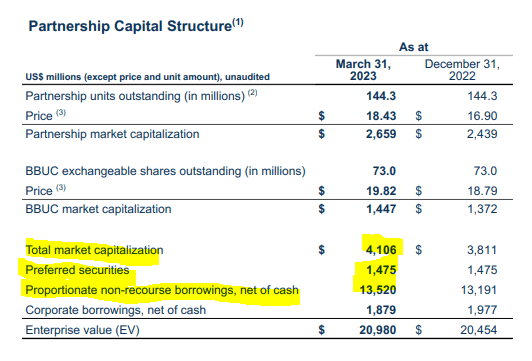

Consolidated ranges right here come with even parts of those firms no longer managed via BBU. A special approach to have a look at that is via inspecting the ratio of the fairness marketplace capitalization of BBU and proportionate non-recourse borrowings. This quantity is in a equivalent zone, and you’ll see the leverage ranges dominating the image.

BBU Q1-2023 Presentation

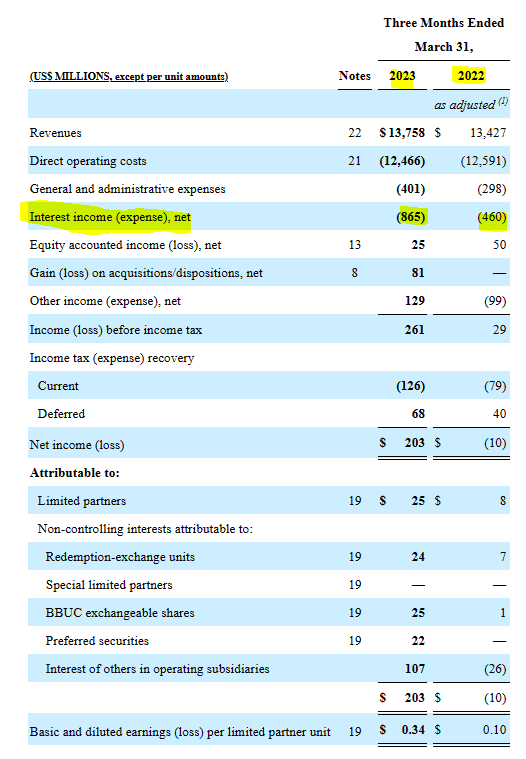

One different attention-grabbing solution to read about the leverage is to have a look at the obvious outdated source of revenue commentary, with out entering the entire “adjusted” stuff. Right here you’ll see how the pastime expense has nearly doubled 12 months over 12 months to $865 million.

BBU 6-Ok

Outlook & Valuation

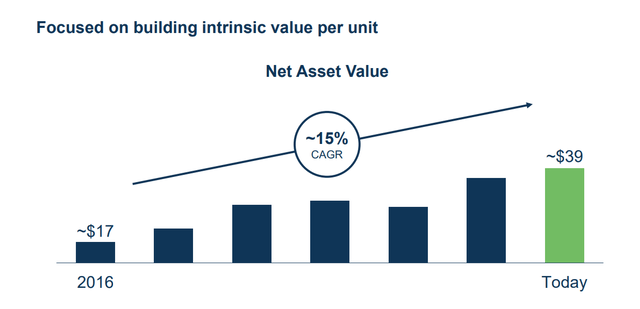

In case you are a Brookfield fan, you forget about the entirety we are saying and simply cross with BBU’s self-assessed web asset worth for the September 2022 presentation.

BBU September 2022 Presentation

$39, ergo, purchase at $17.70. We expect the ones numbers are up to now got rid of from fact that we’d simply throw them out and get started recent. Even for those who are vulnerable to imagine the Brookfield shows, remember the fact that they took Brookfield Belongings Companions L.P. personal at an enormous bargain to the self-assessed NAV.

All of the underlying subsidiaries elevate a lovely really extensive chew of leverage and when you alter go out EV to EBITDA multiples down 1-3X, you’ll in finding that even the $18 present inventory value may well be positive. We in reality noticed one case find out about for BBU play out closing 12 months the place the sale of Westinghouse used to be assumed to happen at 14X EV to EBITDA and spice up BBU’s NAV via $7.00. The real sale came about at 10.5X EV to EBITDA and required every other Brookfield entity to in reality purchase part the stake. We can upload that every one of the ones negotiations came about at a time when everybody believed the terminal Fed Finances charge can be beneath 4%. So at the entire, we see a difficult set of stipulations for BBU to monetize belongings at anyplace with reference to its reported NAV. However that’s not all. The prevailing companies do must refinance their debt, and we will be able to see this play out over the following couple of years. Actually, BBU used to be requested about this and pointed to the truth that one corporate of their fold, prolonged its debt in a reasonably uneventful way.

Geoff Kwan

K. In truth, perhaps if I will be able to ask one closing query. You mentioned doing debt refinancing at various your firms. While you check out the portfolios lately, like, would there be different – how a lot more – do you suppose it’s possible you’ll both must do or the place you suppose there is a window to opportunistically prolong time period at an affordable price?

Jaspreet Dehl

Sure. So Geoff, we are repeatedly roughly looking at the marketplace and we love to be opportunistic the place we will be able to. However simply when it comes to roughly our total debt profile. So the weighted moderate adulthood at the debt lately is 5.5 years. Mark touched at the contemporary refinancing that we did at Clarios that in reality extends our maturities now to five.8 years. And within the subsequent one year, now we have were given 5% debt maturing of our total debt. So there is no longer a complete lot that is very forthcoming for us.

Supply: BBU Q1-2023 Transcript

Neatly, that refinancing discussed used to be for Clarios, most definitely certainly one of BBU’s maximum strong companies. The cyclicals don’t seem to be doing so neatly relating to refinancings. Allow us to display you GrafTech World Ltd. (EAF), a publicly traded corporate the place BBU owns about 25% of the fairness. EAF has some problems that transcend simply the cyclical nature of the trade (see this). However the numbers are nonetheless eye-popping relating to debt refinancing.

BROOKLYN HEIGHTS, Ohio–(BUSINESS WIRE)– GrafTech World Ltd. (“GrafTech”) lately introduced that its oblique, wholly-owned subsidiary, GrafTech International Enterprises Inc. (the “Issuer”), priced its personal providing of $450 million mixture major quantity of 9.875% Senior Secured Notes due 2028 (the “Notes”), together with $11.4 million of unique factor bargain to yield 10.500%. The Notes might be issued at a value of 97.456% in their mixture major quantity. The providing is predicted to near on June 26, 2023, topic to normal ultimate stipulations.

The proceeds from this providing are meant for use to pay off the debt exceptional beneath the secured time period mortgage facility supplied for via the credit score settlement entered into via GrafTech in February 2018 (as amended, the “2018 Credit score Settlement”) and pay all comparable charges and bills and, to the level any proceeds stay, for basic company functions.

Supply: In the hunt for Alpha

The click unencumber is moderately garbled additional down, however apparently that the issuance is getting used to repay debt at 4.625%. Even in isolation, pricing at 10.5% is hardly ever affordable. That is about part in their general web debt of $950 million, so pastime prices are going during the roof for no less than one BBU child.

Verdict

Is BBU going to head beneath? No. They’ve maintained a blank steadiness sheet on the company stage. A few of their extra defensive names like Clarios are doing fairly neatly.

As a reminder, Clarios is the sector chief in low voltage batteries, powering one in 3 cars globally with unrivaled scale and geographic succeed in. We’re 5 to 6 occasions higher than any of our nearest competition and we are the one true international participant. We’ve got the #1 marketplace place within the Americas and Europe and are lately quantity 3 in Asia. To position this in context, we send over 150 million batteries in step with 12 months. And when the trade used to be obtained via Brookfield, EBITDA used to be roughly $1.6 billion. We set a file 12 months of profits in fiscal 2021 and we proceed to make robust growth in fiscal 2023 and plan to exceed $2 billion of EBITDA over the following couple of years. And relying on how a lot we reinvest within the enlargement, the trade will have to generate a minimum of $500 million or extra of unfastened money drift every 12 months. Roughly 80% of the quantity is pushed via the top margin resilient aftermarket call for. We are additionally the go-to spouse for just about each automaker on the earth, and in lots of instances have majority proportion, bringing the suitable ranges of era to unravel for his or her demanding situations of lately and the longer term.

Supply: BBU Q1-2023 Transcript

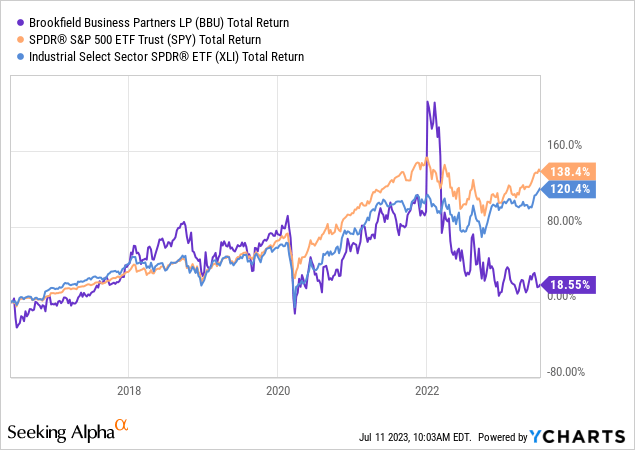

That is balanced via maximum in their cyclical names being closely leveraged and prone to face torturous refinancings. The efficiency since inception has been underwhelming and BBU has trailed the wider S&P 500 (SPY) and Business Make a selection Sector SPDR (XLI) via greater than 100%.

We do not be expecting BBU to fix this deficit any time quickly. The inventory would possibly make sense for those who imagine that the following charge minimize cycle is set to start out and BBU’s self-computed NAV is correct. We do not purchase both, and therefore, we do not wish to purchase BBU.

Please observe that this isn’t monetary recommendation. It’s going to appear find it irresistible, sound find it irresistible, however unusually, it’s not. Buyers are anticipated to do their very own due diligence and seek advice from a qualified who is aware of their goals and constraints.

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness