Funtap

Funding thesis

Our present funding thesis is:

- SAP’s funding in its cloud merchandise appears to be producing stepped forward returns, with enlargement accelerating and the scope for margin development enhanced.

- We see additional {industry} tailwinds that may fortify long run enlargement, as neatly because the scope for M&A thru money usage.

- SAP is extremely sexy because of its vary of goods and deep integration inside companies, taking into account accretive returns over the years.

- SAP appears unattractive relative to its friends but if adjusted for income, we imagine the corporate is priced as it should be.

Corporate description

SAP SE (NYSE:SAP) is a German multinational instrument company that focuses on endeavor instrument answers. With an international presence, SAP gives quite a lot of services to lend a hand organizations streamline their operations, arrange industry processes, and make data-driven selections.

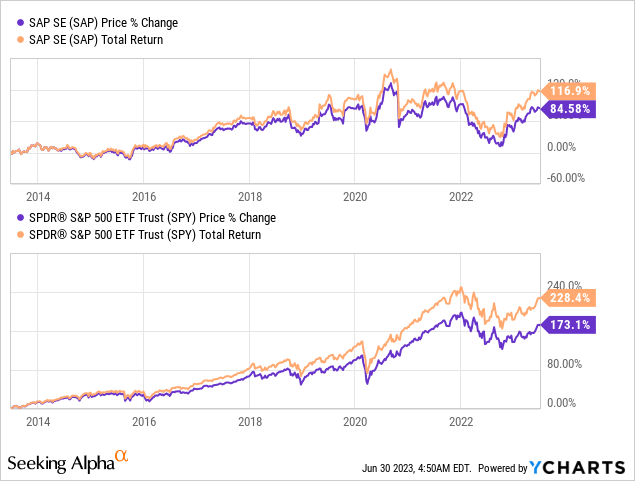

Proportion value

SAP’s proportion value has noticeably underperformed the marketplace, as the corporate’s enlargement trajectory has softened and its profitability weakened.

Monetary research

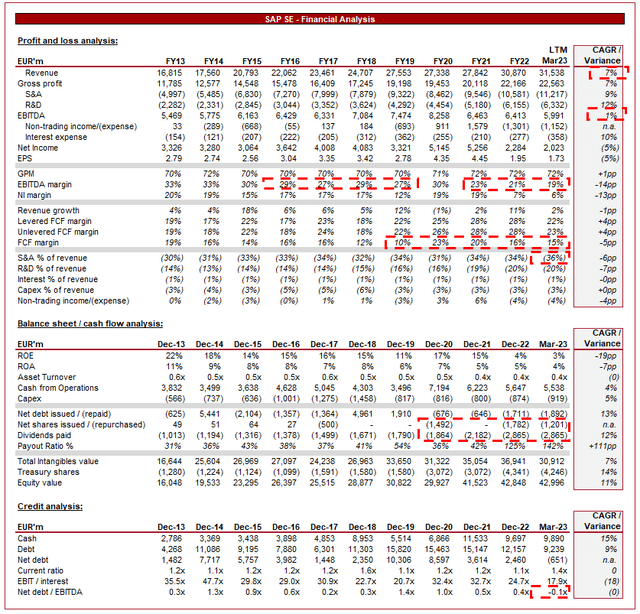

SAP financials (Tikr Terminal)

Introduced above is SAP’s monetary efficiency for the decade.

Earnings & Business Components

SAP’s income has grown at a CAGR of seven% within the closing 10 years, with just a unmarried length of damaging enlargement (Covid-19). This can be a mirrored image of SAP’s spectacular resilience and the horny nature of the instrument {industry}.

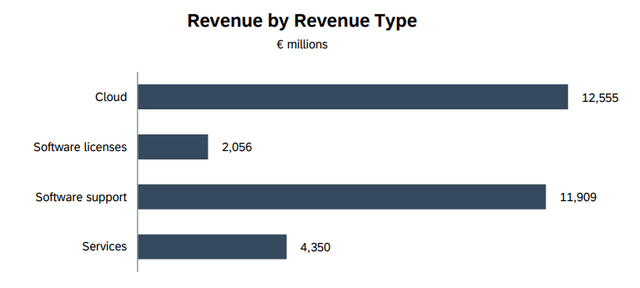

Industry Type and Aggressive Positioning

SAP follows a instrument licensing and fortify industry fashion, offering consumers with licenses to make use of its instrument answers and ongoing fortify and upkeep products and services. SAP gives a complete suite of endeavor instrument merchandise, together with endeavor useful resource making plans (The main of which is S/4HANA), buyer courting control (CRM), provide chain control (SCM), and human capital control (HCM), amongst others. SAP’s income is recently divided into 4 segments, which will also be cut up into 2 number one classes: Extra Predictable and Different. “Different” represents Instrument licenses, which is the place a buyer takes possession of a instrument package deal, and “Services and products”, which can be consultancy products and services.

Earnings profile (SAP)

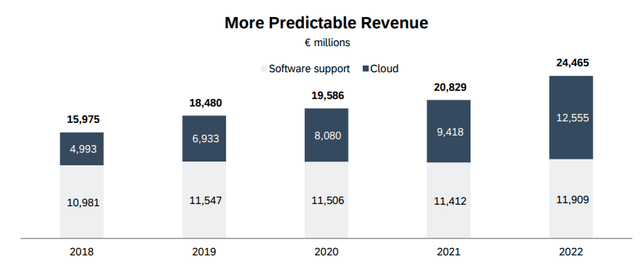

Instrument subscriptions are extremely sexy because it creates a point of sure bet over income. A shopper will typically pay in advance once a year for years if the product is just right sufficient. The routine income method SAP’s function is to win new consumers, as its “base” degree is kind of safe (that is quite oversimplified as we should account for Churn, which is low on the subject of SAP). Of SAP’s €30.9bn of income, it defines €24.5bn of it as “Extra Predictable”, or 79%.

Predictable income (SAP)

SAP’s function is to be a Company’s one-stop store for operational products and services, supporting companies of all sizes and importantly, at an expanding degree as they growth in dimension and complexity. Integrated inside this are industry-specific products and services, once more maximizing the corporate’s achieve. Corporates are fascinated by comfort and value, in addition to charge, and serve as. SAP supplies a option to this at a holistic industry procedure degree (by means of a number of of its choices). For its consumers, this implies digitization and optimization of its processes, bettering productiveness, and offering actionable insights.

The advantage of this comparable carrier means is that SAP has vital scope for upselling / cross-selling, as merchandise paintings jointly as a part of a much broader “eco-system”. This streamlines the guide facet of the Company, bettering price. Additional, higher integration reduces the power to simply “untangle” SAP from its purchasers, contributing to stickier income and the power to constantly follow inflationary value will increase.

Given the reliance on offering a market-leading option to its shopper, SAP continues to speculate closely in R&D. Spending has higher from 14% of Earnings in FY13 to twenty% in LTM Mar23, illustrating its dedication to R&D.

Endeavor Answer Instrument Trade

Festival is fierce within the Endeavor Answer section, as the opportunity of profitable returns has inspired many cutting edge companies into the marketplace. Corporations differentiate themselves in line with elements equivalent to answers, product capability, scalability, and integration functions.

SAP’s number one competition are the key instrument companies, together with Oracle Company (ORCL), Microsoft Company (MSFT), Intuit (INTU), and Salesforce (CRM), in addition to the rising checklist of more youthful marketplace entrants equivalent to Workday (WDAY) and ServiceNow (NOW).

The call for for Endeavor Answers has impulsively higher within the closing 2 a long time, as organizations international are present process virtual transformation, with the target of bettering operational potency and decision-making processes. This development has most effective higher, as an increasing number of industries combine instrument into their operations. It’s now a demand for many companies of a undeniable dimension. Because of this, we suspect the {industry} trajectory will proceed.

The shift against cloud-based instrument answers items alternatives for enlargement, as corporations more and more include the versatility, scalability, and cost-effectiveness presented through cloud platforms. This development has been pushed through the higher globalization of businesses’ operations, in addition to the declining charge of cloud answers. SAP has invested closely within the construction of its Cloud-based answers, which is its biggest industry section and the quickest rising, looking for to boost up its enlargement trajectory during the construction of a awesome product. Cloud income and backlog are up 24% and 25%, respectively, in Q1-23, with S/4HANA cloud income up 77%. This underpins a powerful trajectory in recent times, as Control believes they’re at an inflection level, with oversized enlargement forward.

The combination of AI and ML applied sciences into instrument programs is riding automation, predictive analytics, and clever insights, bettering the worth proposition for purchasers. We imagine this to be the herbal subsequent step in technological construction inside the {industry}, following the mass incorporation and Cloud section. SAP has an implausible basis upon which to construct a awesome providing (its merchandise are already utilized by purchasers equivalent to Accenture (ACN)), with our trust that AI might be the road to put money into. Oracle, as an example, is already a pacesetter in using system finding out however generative AI specifically is ripe to be exploited.

Margins

SAP has traditionally boasted robust margins, reflecting the horny economics of this {industry}. Lately, alternatively, margins have noticeably declined. The corporate recently has an EBITDA-M of nineteen% and a NIM of 6%.

Margins have because of the desire for funding in its cloud providing, materially impacting SAP’s working profitability post-FY20. This funding is obviously noticed in R&D, which has higher at a CAGR of 12.7% between FY19 and LTM Mar23. Control is of the realization that the funding required is widely made, with double-digit working benefit enlargement forward. In the newest quarter, SAP’s S&A and R&D spending declined QoQ for the primary time in different quarters, supporting this view. It’s vital, alternatively, that GPM development is delivered constantly, given the next implies a point of volatility this is materially impacting OPM/EBITDA-M.

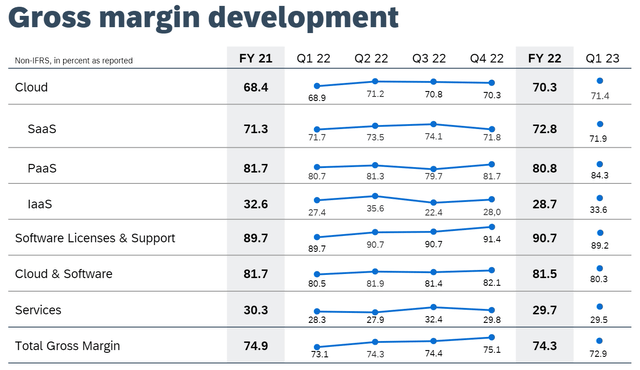

GPM construction (SAP)

Steadiness sheet & Money Flows

SAP is a conservatively financed industry, with virtually €10bn in money and a internet money place. We wish to see the industry flip competitive with its capital allocation, undertaking additional M&A to fortify its present enlargement trajectory.

As a SaaS-based instrument industry, its money go with the flow technology is terribly just right and constant.

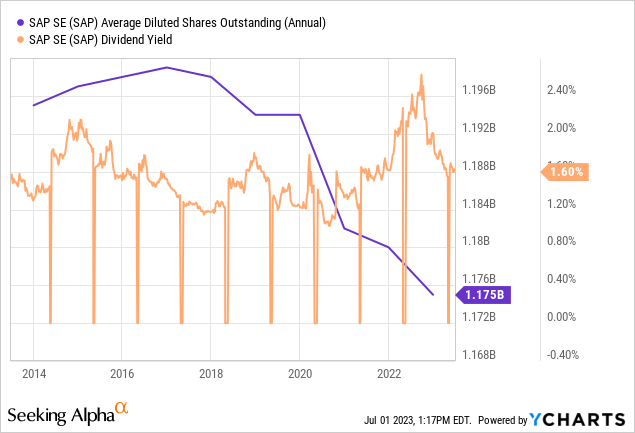

Distributions to shareholders were robust, with dividends rising at a CAGR of 12%, accompanied through periodic buybacks.

Outlook

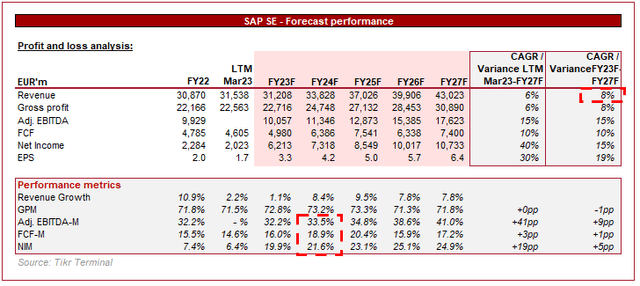

Outlook (Tikr Terminal)

Introduced above is Wall Side road’s consensus view at the coming 5 years.

Analysts are forecasting a slight uptick in enlargement, with a CAGR of 8% into FY27F. This seems to be conservative relative to Control’s expectancies however we deem them cheap given the loss of dependable visibility going ahead. We should no longer disregard that cloud is most effective 40% of income.

Margins are anticipated to regularly make stronger over the approaching 5 years, as Control turns its focal point on charge financial savings following the massive funding. Given the shaky GPM in Q1 regardless of the Opex cutback, we imagine hesitancy is cheap and so those forecasts glance suitable. Be aware, that is adjusted income and so a portion of the advance will likely be hidden in definitions.

Peer research

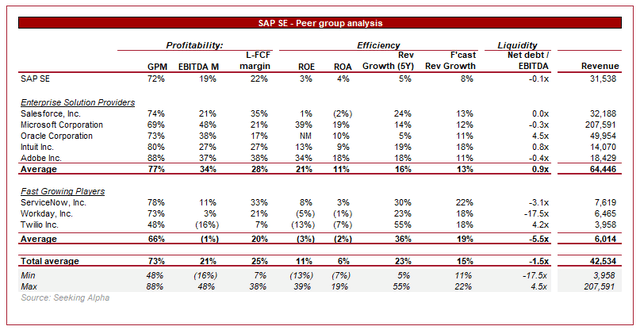

SAP relative efficiency (Tikr Terminal)

Introduced above is a comparability of SAP to a cohort of its without delay related friends.

SAP relatively noticeably underperforms, which is most likely the cause of its deficient proportion value efficiency relative to the marketplace.

From a profitability point of view, the corporate trades at a noticeable deficit to the vast majority of its friends, most effective related to Salesforce, which generates some distance higher FCF. Additional, Workday and ServiceNow are already related in FCF technology whilst nonetheless within the enlargement section, implying a regarding superiority.

Enlargement traditionally has been the most important space of outrage, as SAP’s 5% is most effective related to Oracle, with all different companies within the wholesome double digits. We imagine this displays SAP’s lack of ability to answer higher pageant, which most likely drove the verdict to speculate closely in its cloud functions. This marketplace proportion loss may not be simply received again regardless of the robust early enlargement. On a ahead foundation, the delta appears to be last however SAP stays a lagging performer.

In line with this, we imagine SAP will have to be buying and selling at a noticeable cut price to its peer team.

Valuation

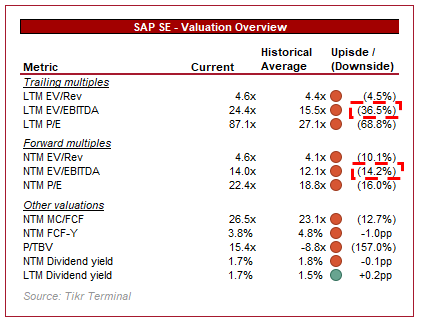

SAP Valuation (Tikr Terminal)

SAP is recently buying and selling at 24.4x LTM EBITDA and 14x NTM EBITDA. This can be a top rate to its ancient moderate.

Given the margin development forward purely from chopping prices, those multiples will briefly decline, implying markets are pricing SAP at about its moderate ancient degree. Our view is that this can be a cheap overview. The numerous development in its cloud merchandise will have to fortify enlargement at a degree traditionally succeed in (at a SAP degree, Cloud will outperform). Additional, the margin development analysts are pricing in will deliver SAP again in step with its ancient degree, once more suggesting a reversion to the imply.

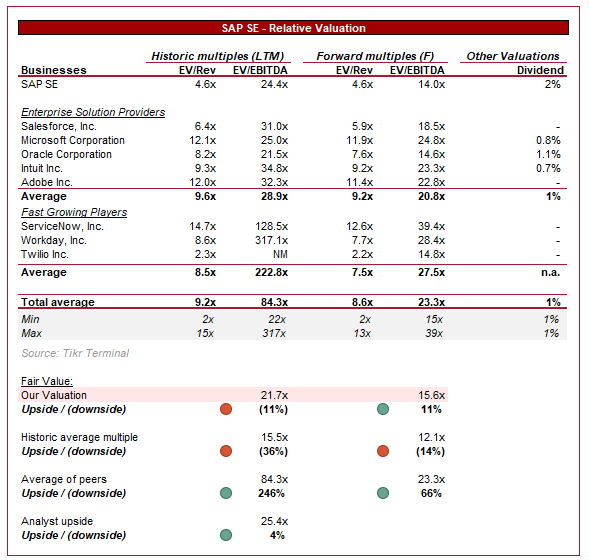

SAP valuation (Tikr Terminal)

In an effort to price SAP, we’ve carried out a 25% cut price to the related peer team, so that you can mirror the weak spot in monetary efficiency. In line with this, we goal an upside of eleven%, related to analysts’ consensus of four%.

SAP’s proportion value is up 47% within the closing 12 months, with traders apparently taking the vast majority of the upside to be had from the advance in efficiency forward.

Ultimate ideas

SAP is a fine quality industry, owing to its extensive vary of goods, profitable industry fashion, and aggressive positioning. 99 of the sector’s biggest corporations are SAP’s consumers, illustrating its integration. This mentioned, the corporate has struggled with higher pageant in recent times, and in line with its outlook, its massive funding will act as a reversion to the imply.

We see some upside with SAP on a relative foundation however we imagine on a risk-adjusted foundation, a cling is an acceptable score. SAP nonetheless must execute on its cost-cutting workout and margin development.

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness