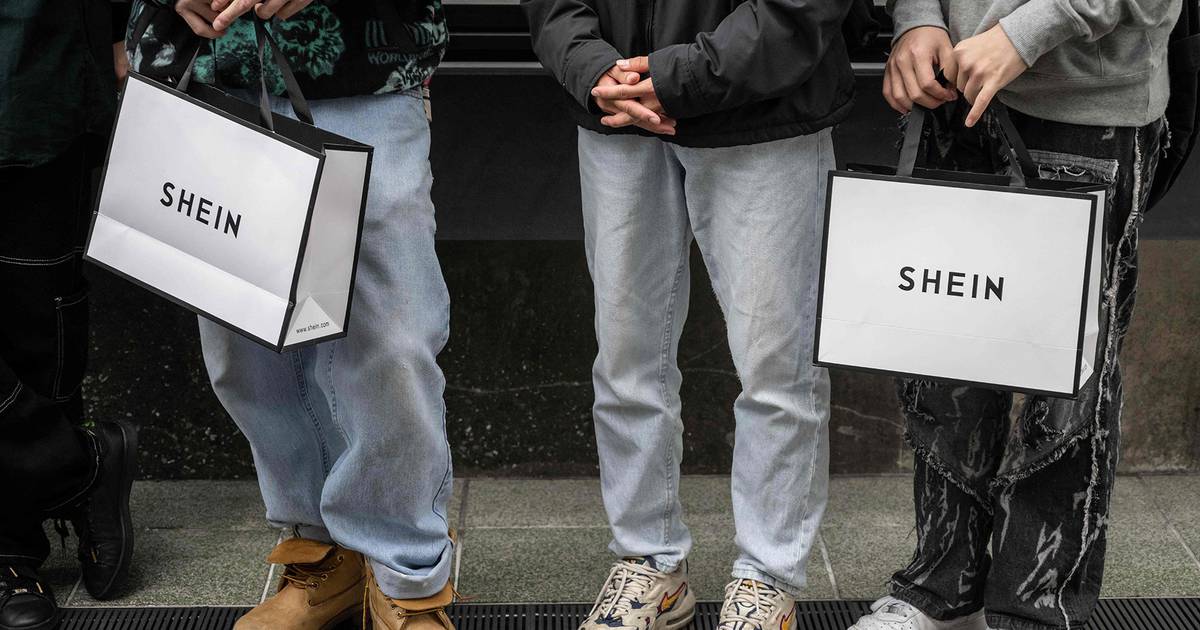

Shein, the Chinese language on-line type store value greater than $60 billion this is below scrutiny from US lawmakers over its labour practices, has registered with regulators for an preliminary public providing in New York, other folks aware of the topic mentioned.

The inventory marketplace debut may make Shein probably the most precious Chinese language corporate to move public in the US since ride-hailing large Didi World indexed in New York in 2021 at a $68 billion valuation. Didi was once delisted from New York a yr later amid Beijing’s crackdown on Chinese language generation giants over antitrust and information safety laws.

Shein has confidentially submitted its IPO registration with the USA Securities and Alternate Fee (SEC), the assets mentioned. The inventory marketplace debut may come ahead of the top of 2023, the assets added.

The assets asked anonymity for the reason that topic is confidential.

A spokesperson for Shein mentioned by way of e-mail that the corporate “denies those rumours.” The spokesperson didn’t in an instant reply to a request for additional main points. The SEC declined to remark.

In urgent on with its IPO plans, Shein is braving heightened tensions between the US and China over industry, delicate generation, human rights and the way forward for Taiwan.

Its IPO is adverse by way of a bipartisan staff of 2 dozen US representatives, who’ve requested the SEC to ensure the corporate does now not use compelled labour ahead of permitting it to continue with a New York record.

Shein has mentioned it adheres to moral sourcing requirements and has denied allegations that it ships from China’s Xinjiang area, the place fabrics akin to cotton are regularly the fabricated from compelled labour by way of the Uyghurs, a principally Muslim ethnic minority. The USA bans exports from Xinjiang because of this.

US lawmakers also are in search of to limit the “de minimis” tariff exemption broadly utilized by e-commerce outlets akin to Shein to ship orders from China to the US. A federal transient in April accused Shein of exploiting the exemption to keep away from tasks and import illegally made pieces.

Shein was once valued in far more than $60 billion in a $2 billion non-public fundraising spherical in March. Normal Atlantic, Mubadala, Tiger World and Sequoia Capital China are amongst its buyers.

Shein has been eyeing a US IPO for a minimum of 3 years however was once deterred by way of headwinds that incorporated US scrutiny of Chinese language accounting practices and bouts of marketplace volatility fueled by way of the Covid-19 pandemic and Russia’s struggle in Ukraine.

The corporate’s founder Chris Xu moved the corporate’s headquarters to Singapore from Nanjing, the capital of China’s jap Jiangsu province, greater than a yr in the past, a transfer that is helping Shein circumvent China’s tricky new laws on out of the country listings.

By means of Julie Zhu and Kane Wu

Be informed extra:

US Lawmakers In finding ‘Extraordinarily Top Chance’ That Merchandise Bought on Temu Are Connected to Pressured Labour

A congressional record says the Chinese language-owned e-commerce industry has inadequate techniques in position to forestall items made by way of compelled labour being bought on its platform.

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness