- This weekly round-up brings you the newest tales from the arena of economics and finance.

- Best economic system tales: Global Financial institution and OECD factor new expansion forecasts; Eurozone entered technical recession in first quarter; Likelihood of US recession drops, in line with Goldman Sachs.

1. Global Financial institution and OECD factor new expansion forecasts

The Global Financial institution has lower its 2024 international expansion forecast from 2.7% to two.4% in its newest International Financial Possibilities file. Central financial institution financial tightening and increasingly more restrictive credit score stipulations had been key components within the lower, Reuters experiences.

Then again, the Global Financial institution has larger its forecast for this yr, predicting that actual international GDP will upward push by way of 2.1%, in comparison with an previous forecast of one.7%. The worldwide economic system grew by way of 3.1% remaining yr.

“The sector economic system is in a precarious place,” mentioned Indermit Gill, the Global Financial institution Workforce’s Leader Economist and Senior Vice President. “Outdoor of East and South Asia, this can be a good distance from the dynamism had to get rid of poverty, counter local weather exchange and refill human capital.

The Global Financial institution’s newest forecasts for the worldwide economic system.

Symbol: Global Financial institution

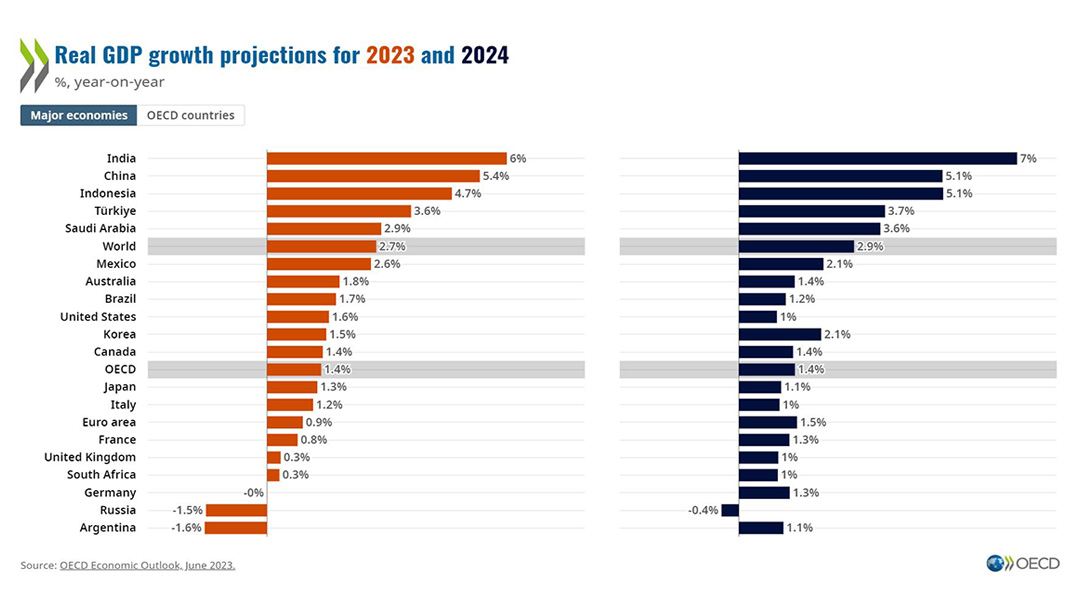

The OECD has additionally larger its forecast for the worldwide economic system over the following yr – despite the fact that handiest somewhat. It has raised its expansion forecast for 2023 to two.7%, up from its March prediction of two.6%.

It sees extra promising possibilities for subsequent yr than the Global Financial institution, forecasting expansion of two.9%, unchanged from its March forecast.

However just like the Global Financial institution, the OECD flagged the continued affect of economic coverage tightening.

“Fiscal coverage will have to prioritise productivity-enhancing public investments, together with the ones riding the golf green transition and boosting labour provide and talents,” mentioned OECD Leader Economist Clare Lombardelli. “Renewed reform efforts to cut back constraints in labour and product markets and to reignite non-public funding and productiveness expansion would make stronger sustainable dwelling requirements and beef up the restoration from the present low expansion outlook.”

India’s GDP is about to develop 6% this yr, in line with the OECD.

Symbol: OECD

The Global Financial Discussion board’s Platform for Shaping the Long term of Monetary and Financial Programs engages stakeholders throughout 5 industries: Banking & Capital Markets, Insurance coverage & Asset Control, Personal & Institutional Traders and Actual Property. The Platform is operating with companions from the federal government and trade sectors to design a extra resilient, environment friendly and relied on monetary machine that boosts long-term price introduction and sustainable financial expansion.

Touch us for more info on the best way to get entangled.

2. Eurozone fell into recession in first quarter

The Eurozone entered a technical recession within the first quarter of this yr, in line with new knowledge from Eurostat.

GDP within the 20-country bloc fell by way of 0.1% in January-March in comparison with the general quarter of remaining yr. This adopted a zero.1% quarter-on-quarter drop in October-December, which means the Eurozone confronted two successive quarters of contraction, which is most often described as a technical recession.

Family spending, public expenditure and stock adjustments all had an affect on quarterly GDP, in line with the statistics company.

3. Information briefly: Tales at the economic system from all over the world

The Australian economic system grew at its weakest tempo in over a yr within the remaining quarter, because of upper costs and emerging rates of interest. The rustic’s central financial institution raised rates of interest to an 11-year top on Tuesday (6 June).

Mexico’s annual charge of inflation fell to five.84% in Would possibly, the fourth consecutive month of slowing.

Brazilian inflation has additionally fallen, hitting its lowest mark in over two years. Annual inflation hit 3.94% in Would possibly, the primary time it is fallen underneath 4% since past due 2020.

The Reserve Financial institution of India, the rustic’s central financial institution, has stored its key lending charge unchanged for a 2d coverage assembly.

It comes as economists are expecting Pakistan will even depart its key rate of interest unchanged on Monday (12 June).

Moody’s, the credit standing company, has warned that UK space costs are set to fall 10% over the approaching two years.

The Financial institution of Canada has larger its in a single day rate of interest to 4.75% – a 22-year top. It is anticipated to observe with an additional build up subsequent month.

The chance of a US recession within the subsequent 365 days has fallen to twenty-five%, in line with Goldman Sachs. Its economists in the past pegged the chance at 35%.

The Turkish lira has hit a document low in opposition to america buck, as the rustic’s new finance minister pursues a plan of “intentional devaluation”, in line with the Monetary Instances.

4. Extra on finance and the economic system on Time table

A brand new PwC survey appears at how organizations can construct resilience, in particular within the face of a “polycrisis”. It unearths that businesses increasingly more see resilience programmes as a supply of aggressive merit, no longer only a way to climate the hurricane.

Global Meteorological Group analysis says that the entire financial prices of climate, local weather, and water-related failures have exceeded $4 trillion during the last 5 many years.

What are the standards shaping the way forward for the banking sector? A newly revealed Banking and Capital Markets Transformation Map explores the important thing traits.

#shorts #shortsfeed #nature #youtubeshorts #iciness

#shorts #shortsfeed #nature #youtubeshorts #iciness